“… a wiser fella than m’self once said, sometimes you eat the bar and sometimes the bar, well, he eats you.”

The Stranger from “The Big Lebowski,” (who was actually talking about bears)

If you’re not a fan of the cult classic movie The Big Lebowski, the message here is, “You win some, you lose some.” But if you’re wondering how much you’re winning and losing in your therapy practice, it’s time to pull up the Profit & Loss Statement (the “P&L” for short, also known as the Income Statement). Once you understand how to use it, the P&L is likely one of the reports that you will use the most.

Every Therapist has different goals when it comes to starting their private practice. Maybe you want to have a better work life balance, pay off your student loans faster, or make a bit more money. The biggest thing you can do to hit your goals is to track your progress.You can track your progress toward your goals by taking a look at your Profit and Loss Report.

If you use QuickBooks for your practice, it is easy to pull a Profit and Loss Report (see step-by-step instructions near the bottom of this article). If you don’t use QuickBooks, you can get a copy of our practice finances spreadsheet.

Let’s start by looking at the P&L section-by-section.

Income and Expenses

It all starts with your income. You might only see one item here (“Service Income”), or you might have different categories of income for private pay clients, co-pays, and insurance reimbursements. All of your income added together is called your Gross Income, which comprises only the “good stuff,” the money coming into your business. At the bottom of the income section is what we accountants would call your Net Revenue but is labeled in QuickBooks as your Total Income.

One of the most important things to keep in mind when looking at income is to look for trends. Is your income increasing or decreasing? Does your income fluctuate a lot, or not very much? If you are unhappy with the answers to these questions then it may be time to bolster your marketing, or change your policies or practices in order to encourage client retention.

[The second section of the P&L is typically dedicated to Cost of Goods Sold. This section is relevant for manufacturing businesses, but probably is not used by your business unless you’re (for example) selling books in addition to providing therapy.]

Next is the section for the reasonable, ordinary and necessary business expenses you have for the running of your private practice – things like rent, “Psychology Today” magazine, and malpractice insurance. You can learn more about personal versus business expenses here.

Pay close attention to the expense section, because you have control over many of the items here. Sure, you can’t decide against paying your taxes or shelling out money for your annual business license. But when it comes to office expenses, software, and especially meals expenses, you probably have a good deal of discretion over how much to spend. Remember: When it comes to expenses, you are the customer.

After income and expenses you might see the cryptically-named “Other Income” and “Other Expenses” categories. These items generally aren’t going to change much — often your only Other Income item is interest income from your bank accounts, and if you have anything in Other Expenses it’s likely just depreciation and interest expense. These items are the effects rather than the causes of big business decisions you make: how much cash to keep in your accounts, how much to spend on assets, and how much debt to accumulate.

Net Income

Last we see Net Income which is your Total Income minus your Total Expenses. Hopefully your net income is positive or “in the black” as opposed to negative or “in the red.” (Fun fact: the phrase “in the black” led to the name of Black Friday, the day when retailers can catch up for their first 10 months of net losses to finish the year positive.)

Net Income = Total Income – Total Expenses

Now, here’s a critical distinction: Net Income is not the same as cash in the bank. Let’s say you have 100 clients who each owe you $100. Fantastic, that’s $10,000 in Revenue. But if none of them have paid you yet, you have $0 in cash from those 100 clients.

Make sure you have the cash in the bank to cover your expenses before you initiate payments to your vendors. If you’re having issues collecting enough money from your clients in order to pay your payables, we call that having cash-flow issues (and are happy to help you manage them).

One last note about Net Income: It’s a key component in the formula to find your Profit Margin:

Profit Margin = Net Income / Total Income

Have you ever heard someone talking about “good margins” or “juicy margins?” This refers to how pure your profit is. In other words, what percentage of the income from your clients actually ends up in your pocket after all expenses are accounted for? Service organizations can often earn better profit margins than manufacturing operations because their materials, supply, and utility costs are usually low.

As a ratio, profit margin is a good way to compare businesses of different sizes. We at TL;DR Accounting can advise you on whether your profit margin is above-average or below-average for a therapy practice, and we can advise you on what to do if you feel unsatisfied by your margins.

Pro tip: Boosting your average session fee is key to improving your margins!

How to Pull Up a P&L

Now that you’ve read our crash course on how to interpret your P&L, here are steps to pull it up for your business:

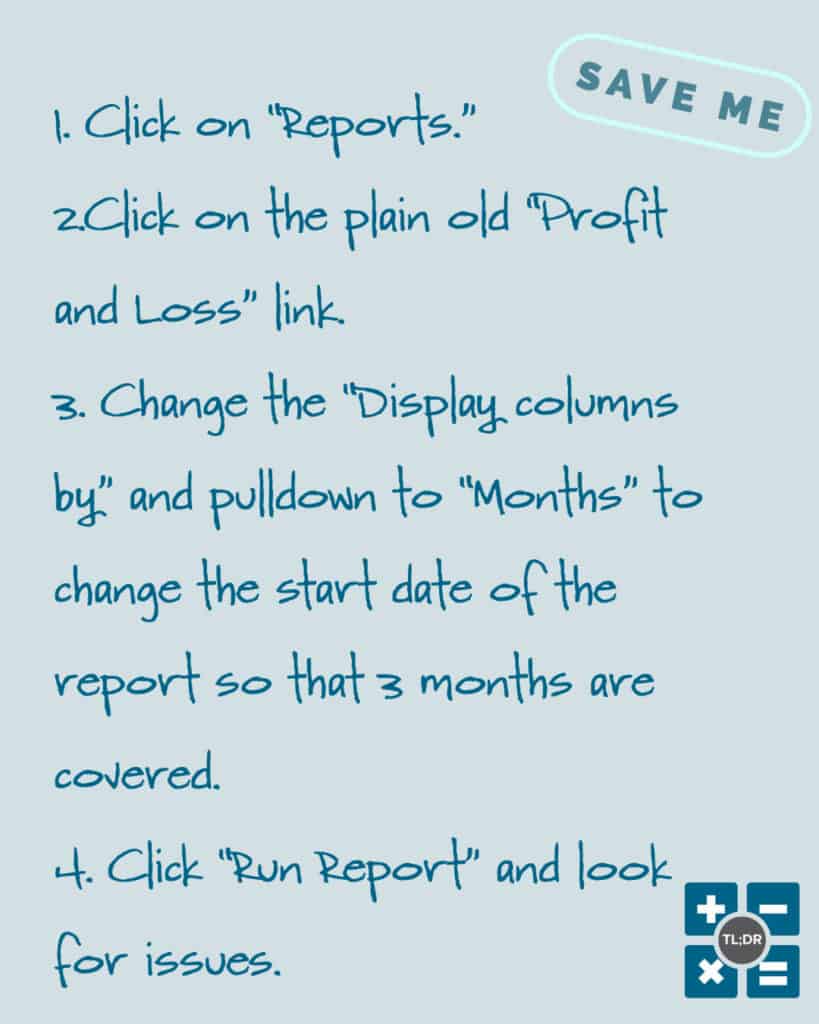

- Once you’re logged into QuickBooks, look at the grey bar on the left. Click on “Reports.”

- By default, the Profit and Loss Statement is listed at the top. If you don’t see it, you can always type “Profit” in the search bar on the top-right and it should show up right away.

- Actually, you’re going to be bombarded with several different options. You can just click on the plain old “Profit and Loss” for now.

- At TL;DR Accounting, we generally do a running 3-month comparison of your P&L activity. In order to do this, change the “Display columns by” pulldown to “Months” and change the start date of the report so that 3 months are covered. For example, if the end date is 7/31, change the start date to 5/1 so that it shows May, June, and July.

- Click “Run Report” and look for the following issues:

- Are there large expenses that you didn’t expect to see?

- Were there any troubling fluctuations in income or expenses that you might not expect to fluctuate like rent or payroll?

- Do you see negative numbers anywhere except for Refunds?

- Are any of your expenses lower than you would expect? This might also warrant investigation.

The Power is Yours!

As the owner of your business, you have an edge over anyone else who might be looking at your P&L: You may not have all the technical knowledge about depreciation, but you do have an intimate understanding of how your business works and where the money should be going. Use that knowledge in conjunction with your P&L to truly understand your operations. Knowledge is power, and knowing is half the battle!

Next week we will cover the Balance Sheet, another report that is always included in the set of reports that accountants refer to as your “Financial Statements.”

TL;DR: A Profit and Loss statement is a report that summarizes your income and expenses for a set period of time. It’s an easy way to look at how much money you are making, and you ought to check it at least once a month. Look for trends when viewing your income, and look for surprises when viewing your expenses. If you have any questions about your P&L (or anything else for that matter), you can always give us a call!