Gusto vs. QBO Payroll: Which Is the Payroll Service for You?

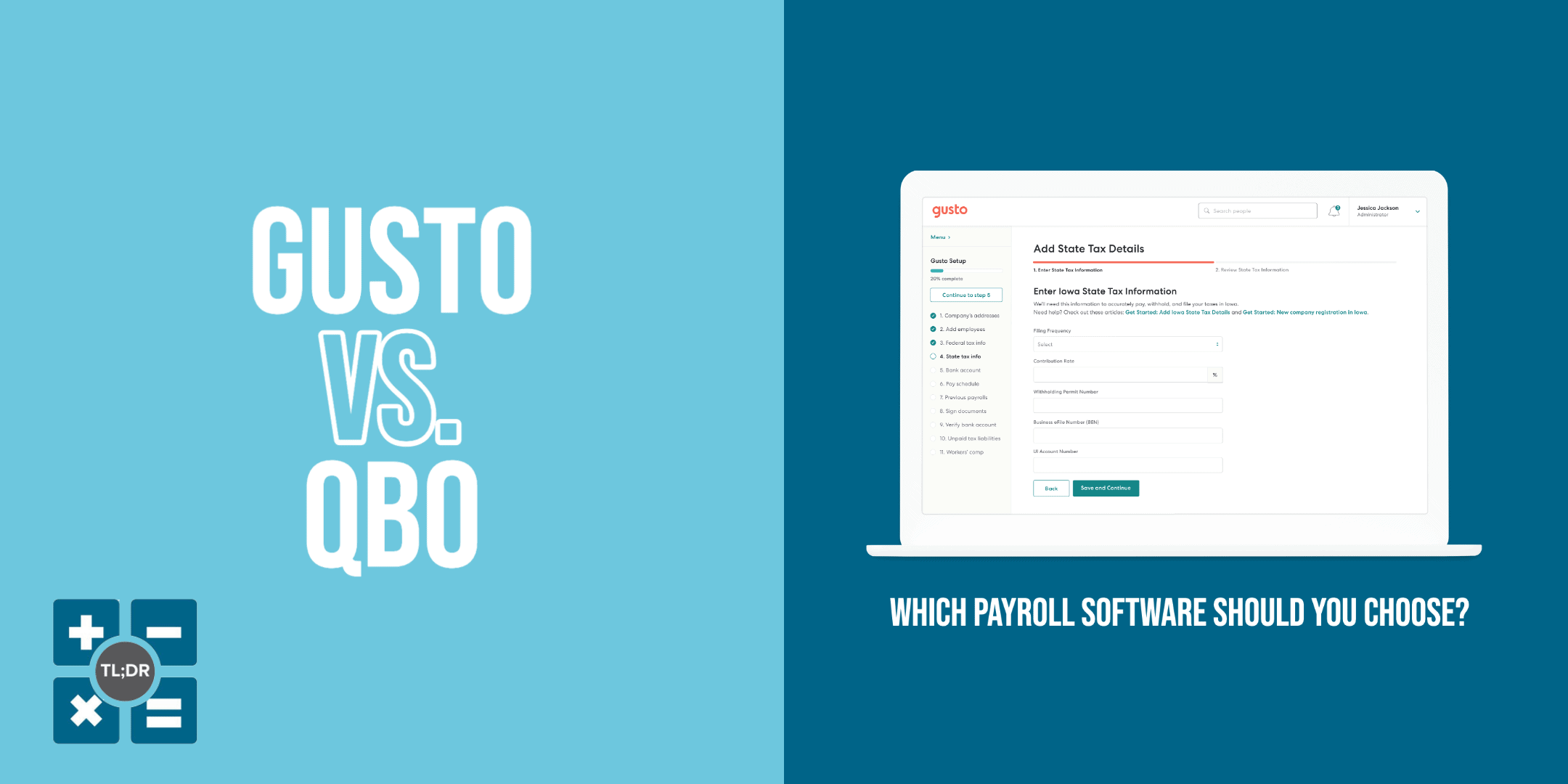

So you’ve hired some employees (or you’ve had employees for a while) and you’re considering getting some kind of payroll software. Let us stop you

So you’ve hired some employees (or you’ve had employees for a while) and you’re considering getting some kind of payroll software. Let us stop you

Time keeps on tracking, tracking, tracking…How do you track your time? You may have noticed by now that Excel is compared to all sorts of

One of the most important ways we leverage our time efficiently here at TL;DR is through the use of effective software tools. It’s like the