It gets late early out there.

~ Yogi Berra

Taxpayer beware. Because taxes can be so difficult, people often put them off until later. They can end up late before you know it, especially since different returns have different due dates. Staying aware of due dates can prevent tax time from sneaking up and surprising you, exposing you to penalties and added headaches!

Personal Tax Returns

Personal tax returns are due Thursday, April 15th. This probably comes as no surprise. Just know that the IRS is generally very firm about due dates, and they may not hesitate to charge you late penalties (and interest on the late penalties) if you file your taxes late.

Perhaps you’ve filed your taxes late in the past and the IRS didn’t charge you penalties. It is important to understand that the IRS will generally not charge penalties or interest if you get a refund on your taxes. However, you may not know whether or not you’ll have to pay or will get a refund, so it behooves you to file on time.

It’s really better to file early (or at least on time) every year. Aside from dodging penalties, it’s good to have the peace of mind in knowing your taxes are behind you. You’re probably a busy person, and it feels good to have that box checked.

Note that if you owe money on your taxes, you’ll need to send payment by April 15th. Calculating your tax owed in January or February can give you a few months’ notice to save up money for a tax payment if necessary.

Business Tax Returns

Since there are several different business entity types in the United States, here’s a quick rundown of the due dates for each:

- Partnership (Form 1065) and S-Corporation (Form 1120-S) tax returns are due March 15th.

- C-Corporation (Form 1120), Trust, and Estate tax returns have the same due dates as your individual 1040: April 15th.

- Not-for-Profit (Form 990) tax returns are due May 17th. (The normal due date of May 15th is on a Saturday for 2021.)

Note that if your business does not operate on a calendar year (your business year-end is not December 31st), then these due dates shift accordingly. For example, if your calendar year ends May 31st, then your 1040 would be due on “the 15th day of the 4th month after fiscal year end” or September 15th.

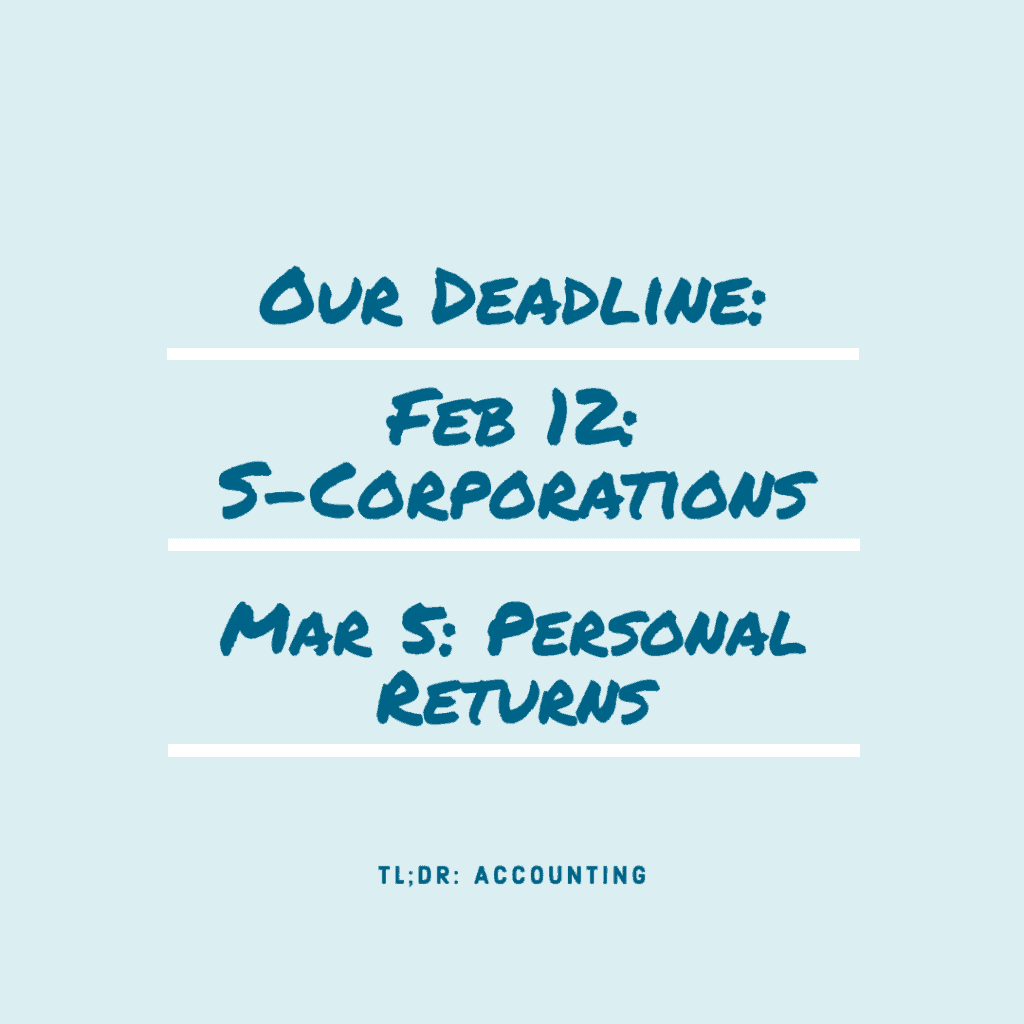

TL;DR Deadlines

We certainly try to be more agreeable than the IRS, but in order to keep our tax season rolling along smoothly we do have specific due dates for our clients:

- For Partnerships and S-Corporations, we require your info by February 12th.

- For personal tax returns and trusts, we require your info by March 5th.

What does submitting your info mean? We need 80% of the questions and documents that we’ve requested via your organizer. Some 1099-Bs won’t be out by then, and we understand that — we only ask that you get us as much information as you can. The initial preparation of your returns takes the longest time, and we like to start it as early as possible in order to leave time for any questions we have or additional information we need from you.

If we don’t receive your information by the above deadlines, then we will extend your return. We must do this in order to keep our commitments to all of our clients who submitted their information on time. Extending your return requires us to estimate your taxes, and if our estimates show that you will owe taxes, you will need to submit a tax payment along with your tax extension form.

Thank you for hearing us out on all of this. Tax season is stressful for taxpayers and tax preparers alike, but we will do our best to meet your needs so that we can succeed together!

For more information:

- Check out our guide to common tax forms.

- For businesses, see what you need to do to get ready for tax season.

TL;DR: As you know, your 1040 is due April 15th. C-Corporation, Trust, and Estate returns have the same due date of 4/15. Partnership and S-Corporation returns are due a month earlier on March 15th. Not-for-Profit returns are due May 17th (for 2021). If TL;DR: Accounting will be processing your tax return, we need your info by February 12th for Partnerships and S-Corporations, and by March 5th for other returns.