Why tip someone for a job I’m capable of doing myself? I can deliver food, I can drive a taxi, I can and do cut my own hair. I did, however, tip my urologist. Because I am unable to pulverize my own kidney stones.

~ Dwight Schrute, “The Office” (TV Show)

Dwight Schrute from the TV show The Office is quite the self-sufficient character, but it could be said that he spends more time than necessary doing things that someone else could do for him. Haircuts, for example, are far easier when you just go to a hair salon and have someone else do it. Hairdressers have plenty of mirrors and specialized tools, and (most of) the hair bits stay in the salon when you leave.

I like to imagine that Dwight researches and does his own taxes for his beet farm — it just fits in with his character so well. But it doesn’t seem that efficient to stay up on every important and relevant tax law if you’re just going to use them once a year on your own return.

That explains why so many business owners seek experts to do their tax and accounting, among other specialties like legal help and 401(k) administration. It just makes too much sense.

We here at TL;DR Accounting think that you made the right decision in hiring us to do your taxes, and not just because it’s business for us. Having an expert do your taxes takes less time, saves you the trouble of looking up arcane tax laws, and there’s always the off-chance that we’ll find some extra deductions that you didn’t know you qualified for! And if you get hit by an audit, we’ll have your back.

Now that you’ve hired us, you might be wondering what will be expected of you. This can feel especially intimidating if you haven’t ever outsourced your tax work before. Don’t worry, we’ll guide you through the whole process which can be separated into three steps:

- Fill an organizer that we will provide to you

- Send us documents that we request from you

- Stay in touch, and sign your return in a timely manner

Filling the Organizer

Once we agree on a contract, one of the first things we’ll ask of you is to fill an organizer that we send to you. While it may sound like a shelving unit, when we say organizer we mean a condensed fillable form that will contain all of the basic information we need from you in order to do your tax return. Having all of this information in the same place is very useful to us because it will help us do your tax return faster, saving us time and saving you money.

The organizer contains sensitive information, so please ensure that any local copies you keep (if you do so) are in a safe place on your personal computer, and not accessible to others. Also, it’s very important to keep us up to date on important changes to your organizer information (e.g. name change, address change, or marital status change).

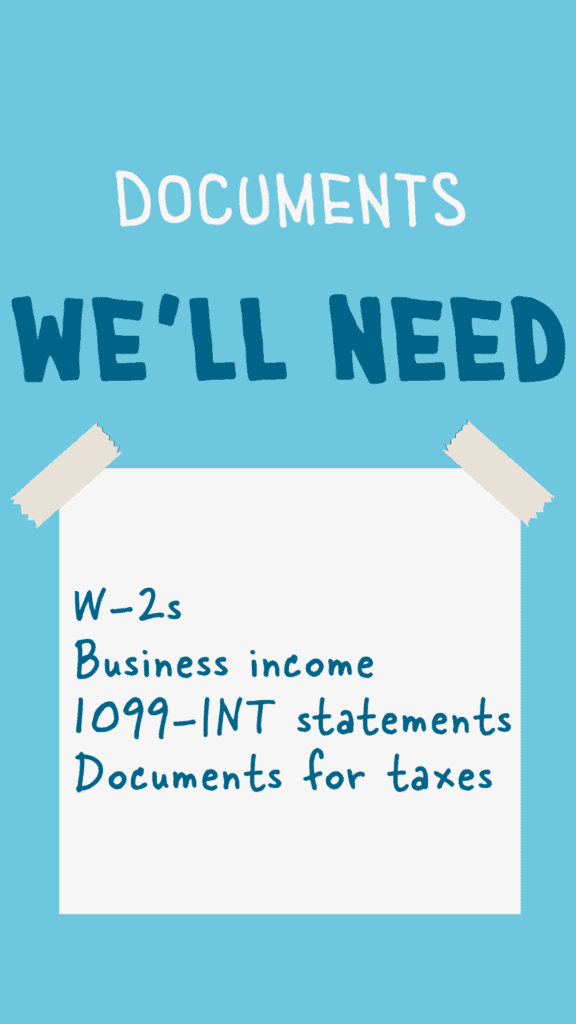

Sending Us Documents

As your tax preparers, there are supplemental documents that we will need from you in order to do your taxes. Our need for some of these documents will be obvious. Of course we need to see documentary evidence of your income: W-2s, business income, and 1099-INT statements from the bank. We will also need any documentation that you used to use to do your own taxes. Whenever you receive any kind of letter from the IRS, chances are we’ll want to take a look at that, too.

There might come a time when we request an unexpected document. If this happens, please understand that we only ask for documents that we need in order to do your taxes. If you feel the need to know why we need a certain document of yours, feel free to ask us, but please understand that our time is very tight during tax season and we may not get back to you immediately. After we review the information you send us we will reach out if we have any additional questions.

Staying in Touch

We don’t just care about your tax returns, we care about you! As a small business owner, personal matters in your life can significantly affect your business. We prefer to know about these kinds of matters as early as possible. Advance knowledge can help us plan your taxes and we can also advise you how certain events in your personal life can affect how your taxes may look next time around.

In case it isn’t clear, the kinds of personal matters we’re talking about include pending changes in your marital or family status, changes in business location, and any long stretches of time during which you will be unavailable for communication — especially if we are working on your tax return.

Please understand that you are not alone. We’re a small business too, and we know this from experience: The fewer the people there are in a business operation, the more that each individual’s personal life affects the business.

TL;DR: Hiring a tax accountant is a big change, and we’re here for you every step of the way! When you hire us, we ask that you fill an organizer in a timely manner so that we can set up your business profile accurately. We would also very much appreciate a quick turnaround when we request important tax documents from you. If there is a big change in your life on the horizon, letting us know early can help us help you plan for the tax effects of such a change. We know from experience that the line between “business” and “personal” can feel blurry at times!