[while dunking the Dude’s head in the toilet]

Blond Treehorn Thug : Where’s the money, Lebowski?

The Dude : It’s uh… uh… it’s down there somewhere,

let me take another look.

~ The Big Lebowski

Right now some of us who are owed tax refunds are asking the same question: “Where’s the money, IRS?” They have been slow to provide refunds this tax season. A big reason for the delay is that the IRS is dealing with all the special provisions and stimulus payments that were designed to help ease the destruction that the pandemic wrought upon our economy.

Some taxpayers, on the other hand, are not wondering where “the money” is because they have decided to apply their tax refunds to their estimated taxes instead of receiving the money now. Let’s explore this idea in three steps:

- What does it mean to apply your refund to estimated taxes, and how do you do it?

- Why would you want to do this?

- When would it be smart to take a refund instead?

What It Means to Apply Your Refund to Estimated Taxes, and How It’s Done

If you’re like most taxpayers who regularly receive tax refunds, you’ve probably been receiving a check or a direct deposit payment some time after your submitted income tax return has been accepted by the IRS. The IRS even provides a refund tracker here which can help you answer the question of “Where’s the money?”

Some taxpayers, for reasons we will explore below, choose not to receive their tax refund as a check or direct deposit payment. Instead of these funds going into their bank accounts, they elect to have the IRS hold the money sight unseen. This money will be held until it is used up to pay for the following year’s estimated taxes.

The process to do this is simple. On Form 1040, simply fill in the dollar amount you want applied to next year’s estimated taxes on line 36 (it doesn’t have to be your whole refund). Note that line 36 plus line 35a (the amount you want refunded now) should add up to line 34 (your total refund).

If you’re using tax software (which we recommend you do), the process is going to depend on what kind of software you use. For those using TurboTax, see instructions here. If you’re using other software, you can contact your software provider or contact us!

Why Would You Want the IRS to Hold Onto Your Money?

Before we get into the benefits of applying your tax refund to next year’s estimated taxes, note that there’s a very good reason why the IRS makes it so easy. The process benefits the IRS because it saves them the work of chasing down taxpayers for payments, which can be time- and resource-intensive. But just because it benefits the IRS, it doesn’t mean that it is necessarily a bad idea for you.

Why might it be a good idea for you?

- You want extra peace of mind regarding penalties and interest. Applying your refund to estimated taxes is no guarantee that you will avoid penalties, but it makes them less likely. If you are penalized, it will reduce the amount of penalties you will face.

- It can afford you an “estimated tax vacation.” Since you won’t have to pay estimated taxes until your refund is used up, you might be able to “get away with” not saving for taxes for a while each year. Nevertheless, we recommend that you save a set percentage of your income every month for taxes regardless. If tax savings is a regular monthly expense, it will likely feel less painful than if it is an “on again, off again” expense.

- Are you prone to tax refund shopping sprees? We’re aware that your tax refund is your money and you can do what you want with it. But we’re accountants, and it’s our job to recommend that you spend your money mindfully. If you feel that it might be difficult to discipline yourself with your tax refund, maybe it’s better if it’s out of your hands.

Note that if you choose to let the IRS hold your money, you only have a very limited time to change your mind. Beware!

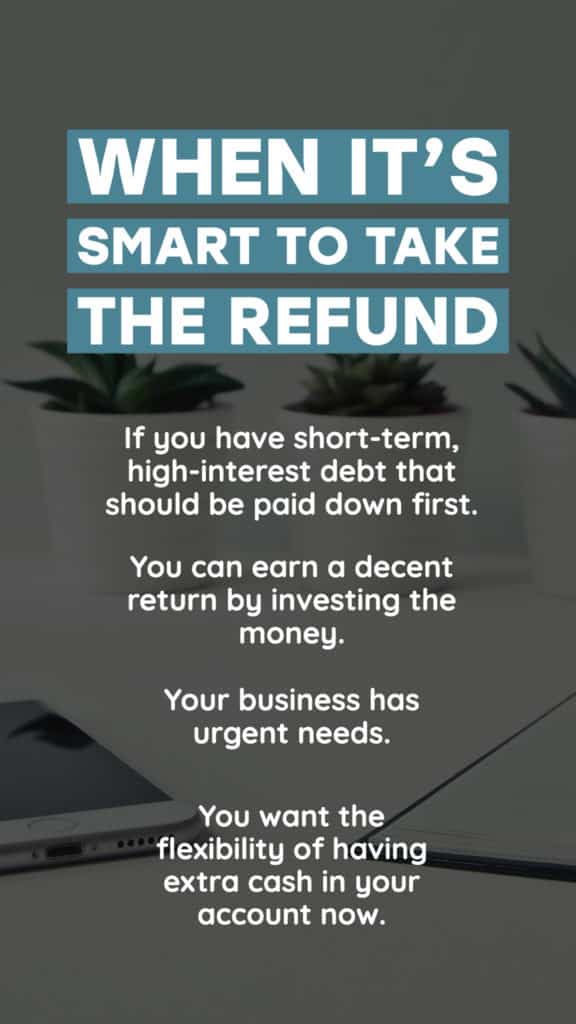

When It’s Smart to Take a Refund Instead

Do you feel unconvinced by the arguments in favor of leaving your money with the IRS? We’re not surprised. The choice of whether to do this is up to you, and there are legitimate reasons for taking the refund for yourself (aside from impulse shopping):

- If you have short-term, high-interest debt that should be paid down first. There are lenders out there that charge much higher interest than the IRS. If you have significant credit card debt and you are determined to not max out your card after you pay it, then paying down the CC might be the smartest choice for now. [If you are able to pay a card down to a zero balance, note that closing a credit card account can affect your credit score.]

- You can earn a decent return by investing the money. Why give the IRS what basically amounts to an interest-free loan if you can increase your earnings by investing your refund into your own business?

- Your business has urgent needs. Speaking of your business (if you have one), you might have urgent needs crying out to you right now! One good example of an urgent business need is payroll — delaying one payroll could lead to all your employees wondering if your business can stay afloat.

- You want the flexibility of having extra cash in your account now. The flexibility to respond to emergencies without dipping into credit card debt can greatly help you in both the short run and the long run!

As a final note, we again highly recommend that you establish a tax savings account (among other savings accounts like retirement and vacation savings) to help you reach your short-term, medium-term, and long-term goals. Our favorite thing is to help people reach their goals!

TL;DR: Applying your tax refund to next year’s estimated taxes is as simple as filling in a box. It could be a good idea if you have doubts about trusting yourself to save adequately for taxes. On the other hand, if letting the IRS hold onto your money means that you might have to charge emergency expenses on a high-interest credit card (which most of them are), it might make more sense to have the cash readily available. Regardless of what you choose here, we recommend that you establish a tax savings account if you haven’t already!