As a business owner or high-income individual, the IRS puts the burden of scheduling and paying estimated taxes on you. They have no duty to remind you, and can and will penalize you if your payment is late or you are unable to pay your amount owed in full.

Since you have no choice in the matter of paying estimated taxes, the best thing you can do is to be organized and minimize your penalties. We recommend calendars and reminders to ensure that you don’t miss any deadlines, or even better, you can have an accounting firm file your estimated taxes for you! Contact us if you’d like our help with that, or with any other accounting-related questions or issues.

Since the IRS is under no obligation to even tell you when you need to start paying estimated taxes, we’ll start by covering the requirements for who has to file. Afterward, we’ll get into how to calculate your tax estimate, and how and when to pay it.

Do I Have to Pay Estimated Taxes?

For individual tax filings, in general, you must make estimated tax payments if you expect to owe $1,000 or more when you file your 1040. Note that the income on your 1040 includes all income from any pass-through entities you own, like S-Corporations or Partnerships.

If you’re wondering why most employees don’t have to pay estimated taxes, even if they make a lot of income at work, it’s because of withholding. Employers are generally required to withhold taxes from the paychecks of employees, and the withholding system is advanced enough that many employees spend their whole careers never owing $1,000 or more in income taxes.

Also note that even if you are an employee and you don’t own a business, you still may have to pay estimated taxes on capital gains, for example, if you sell a significant amount of stock during a single year. Note that we’re talking about withholding and estimated tax here. Even if you don’t have to pay estimated taxes on a sale of stock, you still have to pay income tax on it. Don’t leave capital gains off your 1040!

But we haven’t yet gotten to a very important consideration with regards to estimated taxes: How do you know if you expect to owe $1,000 or more in taxes? This is where forecasting your income tax comes into play.

How to Estimate the Taxes You Owe

There are many quick tools available online to get you started with a rough estimate of how much tax you think you will owe on your 1040. If used correctly, these tools can help you determine whether you should be paying estimated taxes, and they can get you pretty close. Just be prepared to have an extra cushion set aside to make an additional payment when your taxes are filed.

We recommend that you set aside 25% to 30% of your income for your estimated taxes. This should get you close enough to the amount you are going to owe on your federal taxes. Stick to the higher end of the range if you make over $50,000 in the year. If you live in a state that has an income tax, make sure you set aside additional money for that as well. If you would prefer to have an accounting firm prepare your estimated taxes, contact us if you’d like a quote!

If you owe $1,000 or more in taxes, the IRS will not penalize you for late payments if you pay at least 90% of the amount you would have owed in installments. If your income changes unexpectedly, you should adjust your estimated tax payments accordingly throughout the year.

There is a way to get around making guesses about your future tax owed:

If you pay 100% of your previous year’s tax liability and your AGI is $150,000 or less, the IRS promises not to charge you penalties and interest. If your AGI is over $150,000, this percentage goes up to 110%. These IRS promises are called safe harbor rules.

Important note: Safe harbor rules protect you from having to pay penalties, but if your estimated tax payments are less than your eventual tax owed, you still have to pay the difference!

How to Pay Estimated Taxes

Estimated taxes are paid using Form 1040-ES or online. Yes, the form is pretty long for a form that’s only about estimated taxes for individual taxpayers. We’re giving you the “Too Long; Didn’t Read” version of the 1040-ES.

The specifics of the 1040-ES worksheet are beyond the scope of this article. Our recommendation is setting aside 25 to 30% of your income. You can make your payments online at www.irs.gov/directpay. The Type of tax is ‘Estimated Taxes’.

When Are Estimated Taxes Due?

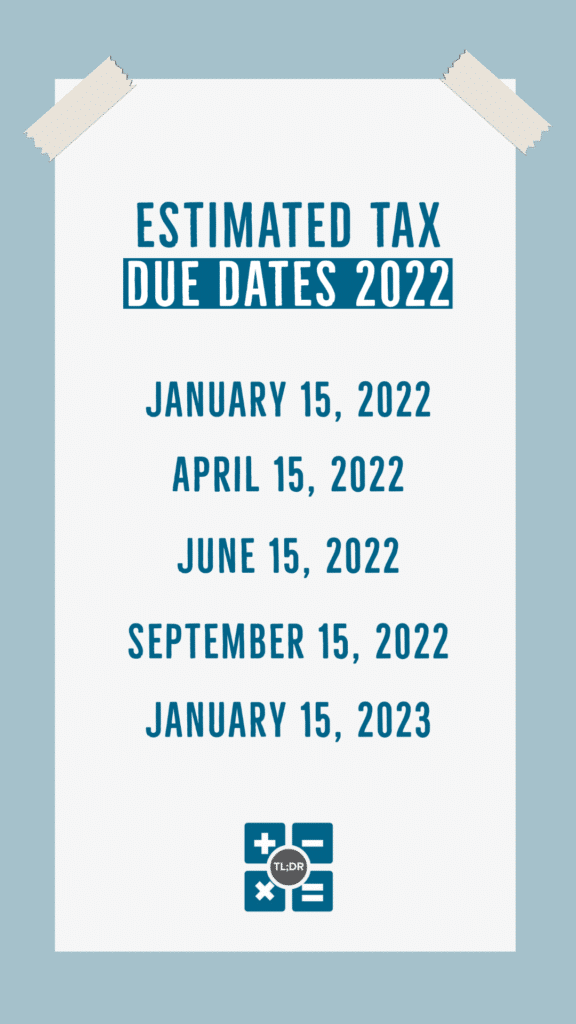

Upcoming estimated tax payments are due:

- January 15, 2022 (Q4 of 2021)

- April 15, 2022 (Q1 of 2022)

- June 15, 2022 (Q2 of 2022)

- September 15, 2022 (Q3 of 2022)

- January 15, 2023 (Q4 of 2022)

What If I Miss a Deadline, or Owe a Penalty?

As we noted in our article about estimated tax due dates, if you miss a deadline, the best thing you can do is to pay what you can immediately and, if necessary, work out a payment plan with the IRS for the remaining amount owed. Unlike regular vendors, the IRS will repay any overpayments if it is determined that your amount owed was overstated. Also unlike your regular vendors, the IRS has the power to force you to pay fines or else face other punitive measures if it is determined that you underpaid. A regular vendor would need a court order to enforce things like this.

We recommend getting the help of an accountant when it comes to negotiating amounts owed, working out a payment plan, or really any kind of dispute or negotiation with the IRS.

TL;DR: If you expect that you will owe $1,000 or more on your 1040 taxes, then you are required to make estimated tax payments 4 times per year. There are two ways to determine your payments: 1) Calculate your expected taxes owed for 2022 and pay at least 90% of that amount (probably a bit more just in case). 2) Pay 100% (or 110% if AGI is $150k or more) of your tax owed for the previous year. We recommend that you hire an accounting firm to estimate your taxes owed if you’re using the 90% safe harbor. Payments are due during the middle of the month in January, April, June, and September, with the first payment for any given year due in April.