Deposition Reporter: [reading off paper] “Mr. Scott, do you realize you just contradicted yourself?” “I did?” “Yes you did.” “Can I go to the bathroom?” “No.” “I really have to, I’ve been drinking lots of water.” “You went five minutes ago.” “That wasn’t to go to the bathroom, that was to get out of a question.” “You still have to answer it.” “First can I go to the bathroom?” “No.”

~ “The Office” Season 4 Episode 12, “The Deposition”

Taking notes is important. It got you through school (you did take notes, right?) and it helps you remember things that were said. More importantly, notes remind everyone of what they agreed to, especially when Eric needs a little reminder of what he signed up for last Thursday (come on Eric, it was even your idea!).

Corporate meeting notes are called “minutes,” but not in the context of time. “Minutes” comes from the Latin minuta scriptura, or “small notes.”

But don’t worry: The purpose of this article isn’t etymology; it’s about the importance of taking minutes during meetings, as well as what kinds of things should be recorded.

Why Are Meeting Minutes For LLC Important?

If you own or are on the board of a corporation, you should be taking notes at your annual meeting. If your board is not meeting at least annually, make it happen! A lot can happen in a year, and it’s important to ensure that everyone on the board is in agreement about the direction of your organization.

As you read in the introduction, one of the most important things to record in your corporate minutes is each decision or agreement made. If a major decision is reached, it can still sow chaos in your board if there are any mis-recollections of the details of said decision. Write this stuff down!

In addition, there’s an important legal reason for minutes. If you don’t record the minutes of your meeting, there is no evidence of your annual meeting, and your corporate liability protection may be at risk. Liability protection might be the whole reason you formed an LLC! As a general rule, if you don’t take your own corporation seriously then the Law might also choose not to take it seriously if you get sued.

But I’m a Solo Corp. Must I Still Take Minutes?

If you’re a solo corporation (a disregarded LLC, a solo S-Corporation, etc.), it might seem silly to have to take minutes. Does it even count as a meeting if only one person is there?

Yes, it does count as a meeting, and yes, you have to have this meeting (or at least write down the minutes for it). This is because the shareholder (You) is meeting with their elected director of the board (You). Be sure to include the fact that you elected You as Director of the Board in your first set of minutes. We’re not kidding here; just do the whole thing as a formality. If you want, you can even use a different funny voice for each position you hold!

How Do I Take Meeting Minutes For LLC?

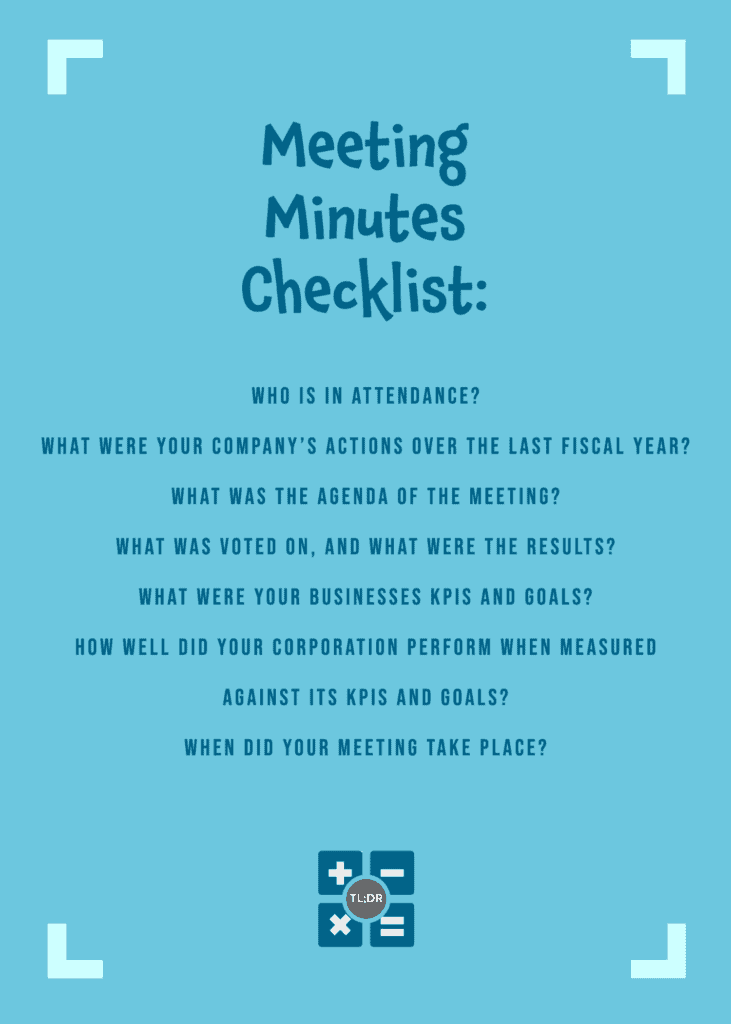

Conceptually speaking, meeting minutes are pretty straightforward. You should record the Who, What, When, Where, and How of your meeting:

- Who is in attendance? For solo corps, make sure to note that you hold multiple titles and what they are.

- What were your company’s actions over the last fiscal year? (Unless you already specified otherwise, your fiscal year is the same as the calendar year.)

- What was the agenda of the meeting? Write a brief description of each agenda item.

- What was voted on, and what were the results of the vote(s)? (If you’re a solo corp, congratulations in advance on passing all your proposed votes!)

- What were your businesses KPIs (Key Performance Indicators) and goals?

- How well did your corporation perform when measured against its KPIs and goals?

- When did your meeting take place? Record the date and time that the meeting took place and the time it ended. Hopefully your meeting didn’t run into the next day!

- Where did your meeting take place? If you’re a solo corp, don’t say “inside my mind,” even if it’s funny. Record the physical location of your meeting.

If you are an S-Corporation, don’t forget to include a copy of your reasonable compensation calculation and accountability plan, each with signed approval!

TL;DR: Having an annual meeting and taking minutes are vitally important for your corporation. They serve as a record of what was voted on and agreed on, and can help ensure that your organization is on track with its goals. Even if you are a solo corporation owner, you must still take minutes. The kinds of things you should be recording are the Who, What, When, Where, and How of your meeting. S-Corporations must also include a signed reasonable compensation calculation and signed accountability plan.