The accrual basis of accounting is one of the fundamental principles that keep million-dollar businesses running. Yes, you read that right. Accrual accounting applies to all business sizes, whether you like it or not. It matters to your therapy practice, like how it matters to a billion-dollar corporation.

We know that the concept of accrual accounting needs to be clarified. Think of it this day. Say you ordered pizza for dinner. Even if you haven’t paid for it, the pizza parlor already recognizes the transaction as revenue and will deliver it even if there is no advance payment.

Hence, cash isn’t the star of the show when it comes to accrual accounting. Instead, we look at when the revenue was earned or when the expense was incurred.

Still a bit confused? No worries! Keep reading, and we’ll break down accrual accounting in the easiest way possible, so it all clicks for you.

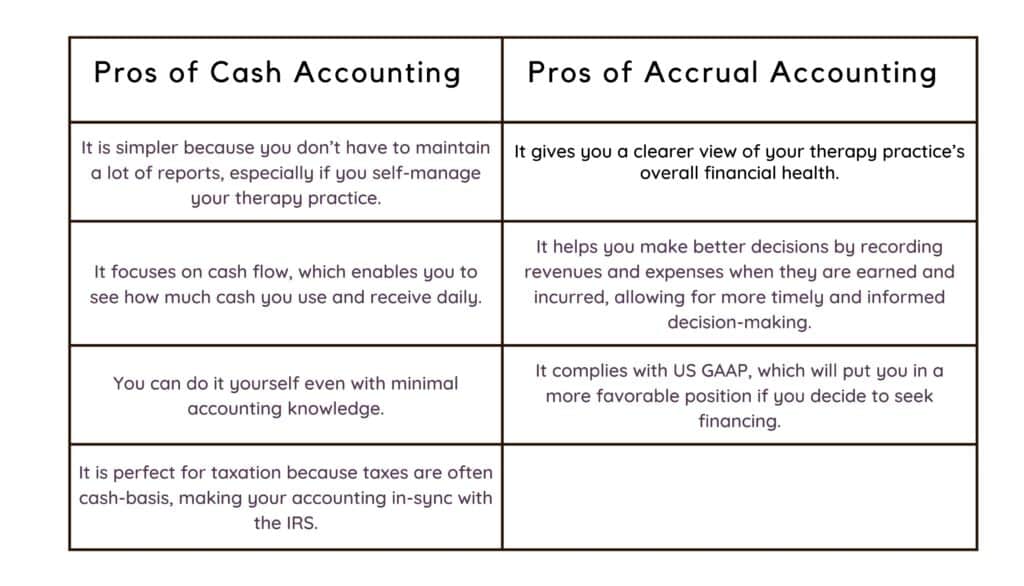

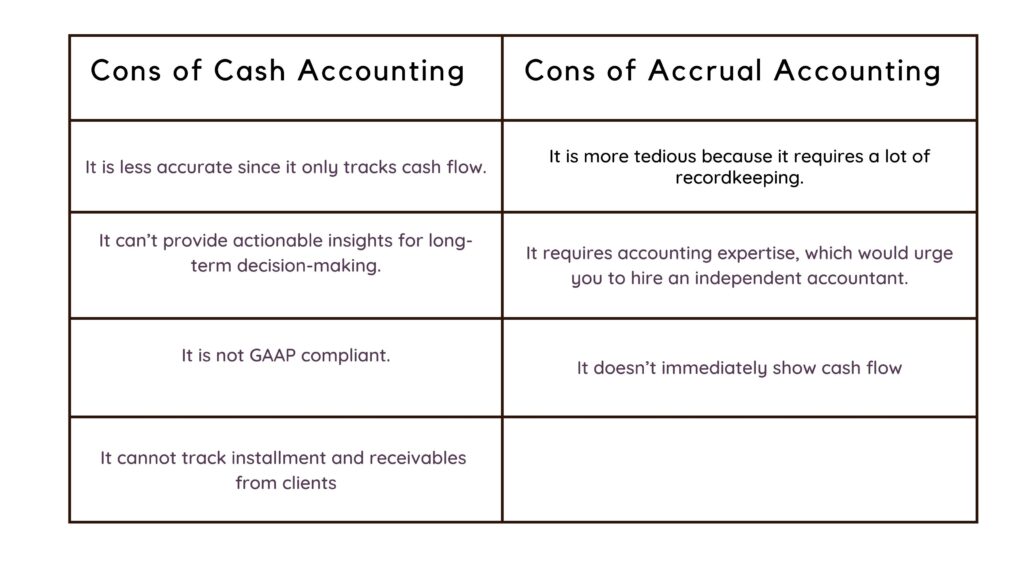

Pros and Cons of Cash vs Accrual Accounting for Therapists

Key Differences

While accrual accounting is the most commonly used today, cash-basis accounting remains popular with some small businesses due to its simplicity. Here are the major areas that distinguish cash-basis from accrual-basis accounting.

- Revenue recognition: Accrual recognizes revenue when earned, while cash-basis recognizes it when payment is received.

- Expense recognition: Accrual records expenses when incurred, cash-basis when they are paid.

- Recordkeeping: Accrual requires more detailed records, while cash-basis focuses on cash inflows and outflows.

- Account adjustments: Accrual needs adjusting entries, while cash-basis doesn’t since revenue and expenses are recorded only when cash is received or paid.

Cash vs Accrual: Income Scenario

On an accrual basis, we recognize income immediately when it is earned. Income is only earned when you have already provided the services to the client. Let’s look at two income scenarios.

Client Pays in Advance

Let’s say a client prepays $1,000 for five therapy sessions at $200 each, held every two weeks. Using accrual accounting, you recognize $200 as revenue after each session, so for the first session in week one, you record $200, and another $200 in week three. In contrast, with cash accounting, the full $1,000 is recognized as revenue immediately upon payment.

Client Pays at a Later Date

Let’s say we bill a client $1,000 for therapy services in September, but payment isn’t due until October 5. Under the accrual basis of accounting, the $1,000 is recognized as revenue in September, even though the payment hasn’t been made yet. However, under the cash basis, revenue isn’t recorded until October 5 when the payment is actually received.

Cash vs Accrual: Expense Scenario

For expenses, accrual accounting works differently from revenues. Remember that expenses are recorded when incurred on an accrual basis. Let’s look at the expense scenarios below.

Purchase in Advance

Your therapy practice purchased $5,000 worth of supplies for sessions, and after a month, only $1,500 is left. Under the accrual basis, you don’t record the supplies as an expense until they’re used. Instead, they’re recorded as an asset, called a “prepaid expense.” At the end of the month, an adjustment is made, recognizing $3,500 as an expense since that’s the amount used.

On the cash basis, however, the full $5,000 would be recorded as an expense immediately when the payment is made, regardless of how much of the supplies have been used.

Payment at a Later Date

Let’s say you received your August electric bill on August 20, with a due date of September 15, and you decide not to pay it immediately.

Under accrual accounting, you record the expense on August 20, when the cost is incurred, even though payment hasn’t been made yet. This is called an “accrued expense.” On the other hand, with cash accounting, the expense isn’t recorded until the payment is actually made. So if you pay on September 15, the expense is recorded on that date; if you pay earlier, it’s recorded on the earlier date.

Get Answers From Accounting Experts

Now, you must be thinking. Which is best for your therapy practice? Both accounting methods have their perks and pitfalls. If you only handle a few clients, the cash-basis accounting is appropriate for your therapy practice. However, if you have multiple clients and accept clients with insurance, the accrual basis of accounting is ideal so you can keep track of all receivables.

At TL;DR Accounting, we’re here to handle all your therapy practice’s accounting needs, making it more straightforward so you can focus on what you do best—helping your clients.

Let’s chat; our team will help you get started with everything you need to simplify your accounting!