It’s April 13th and you’re just sitting down to do your taxes. It shouldn’t take more than a couple of hours, which is good because you still have some shopping to do and some actual work to catch up on. You open up your laptop, and… it has to do a Windows Update. That’s fine, there’s time.

Once your laptop is up-to-date, you pull up your tax software. After confirming your basic information it asks for some important tax documents. Oh right, you’re supposed to have all these documents ready before you get started. Who has the time?

Many taxpayers, like yourself, get all settled and ready to sink a few precious hours of personal time into doing taxes, only to discover there’s extra pre-tax stuff they forgot to do. While we can’t retrieve all of these documents for you, we can at least tell you what they are and where to find them.

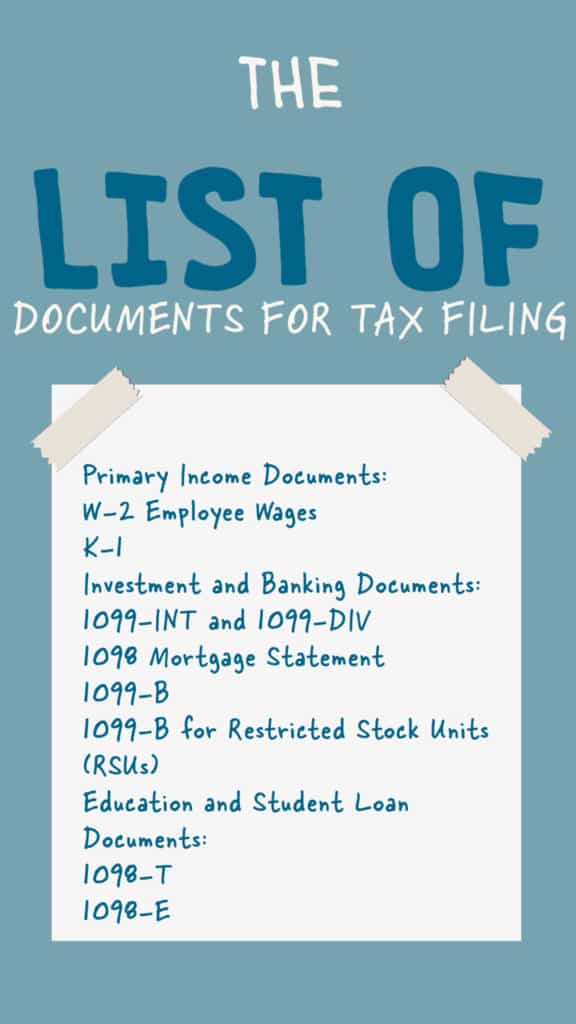

The List of Common Tax Forms

Let’s start off by listing all of the documents that we’ll be referring to in this article. You can treat this like a checklist, ensuring you have all of them before you get started. Of course, you may not have some of these documents (you won’t have mortgage statements if you rent or have a paid-off house). Also, we must mention that this list is not exhaustive.

Documents to collect before starting your income tax filing

- Primary Income Documents:

- W-2 Employee Wages

- K-1

- Investment and Banking Documents:

- 1099-INT and 1099-DIV (these are sometimes combined depending by your banking institution)

- 1098 Mortgage Statement

- 1099-B

- 1099-B for Restricted Stock Units (RSUs)

- Education and Student Loan Documents:

- 1098-T

- 1098-E

Primary Income Documents

If you are an employee, your primary income document is your W-2. Your employer is required to issue this document to you by January 31st of the year following the year in which you worked. Please keep in mind what’s implied here: your employer is not required to issue your W-2 to you before January 31st.

Perhaps you stuffed your W-2 in a drawer somewhere and it’s now lost forever. In that case, you can contact your employer for a replacement W-2. Another option, depending on your employer’s choice of payroll software, is that you may be able to log in and obtain a W-2 yourself without having to wait for your employer to get one to you. This could also head off a bit of awkwardness if you’re a former employee. Yes, former employees still need their W-2 if they worked for the employer at some point during the previous year.

In short, your current (or former) employer is required to provide you with a W-2.

If you are a partner in a partnership or a shareholder in an S-Corporation, the organization must issue you a Schedule K-1 by March 15th, unless they extend filing the business taxes to September 15th. The purpose of the K-1 is to show you what your share of the organization’s income is. As with a W-2, you are expected to report your income on your tax return and hence you must collect this document before filing. Note that if your organization delivers your K-1 on the due date, then you only have one month to file your taxes on time (unless you extend).

On the off chance that you lost your K-1, it got sucked into a Postal Service black hole, or if they never sent it to you in the first place, there’s no need to panic. You can contact the organization itself to request a K-1, or if you’re in touch with the organization’s accountant, you can request it from them. Again, they are required to provide you with your copy of your K-1 — it’s not optional.

Investment and Banking Documents

Now we’ll cover various documents that you will get from your banking institution. At this stage we feel we should apologize that a great many of these documents are called 1098s or 1099s, and that the way the IRS distinguishes these documents is by appending letters at the end, like -B or -INT. It doesn’t make a whole lot of sense, but we didn’t make the rules.

One of the simplest tax documents that you may receive from your bank would be the 1099-INT. This document usually doesn’t have many fields filled out on it; it often boils down to a single number: The amount of interest you’ve earned from that institution during the previous calendar year.

Thankfully, the 1099-DIV is about as simple, except that it’s for dividends instead of interest. Sometimes a bank will combine the 1099-INT and the 1099-DIV onto one statement. Most people with a bank account will get a 1099-INT, even if they only earned a pittance in interest. Sadly, even a pittance is taxable (unless it’s under 50 cents and rounds down to $0).

If you own a home with a mortgage, then you should receive a 1098 from your lender. It will show a few details about the current state of your mortgage and, most importantly, it will list your mortgage interest paid, which is tax deductible if you itemize.

Did you receive a 1098-B for “Proceeds from Broker and Barter Exchange?” The title makes it sound like a receipt you’d get after trading 3 chickens for a sack of grain, but it actually refers to stock market transactions. The major sections on this document are “Proceeds” in 1d, “Cost or Basis” in 1e, the gain/loss type in box 2, and tax withholdings in box 4. To oversimplify, the taxable amount is based on the Proceeds minus the Cost minus the tax already withheld. The rate you pay on the remaining amount is based on the type of gain or loss. In short, a Long Term Gain is taxed the lowest and is for stocks held for more than a year. Short Term Gain rates are much higher, and currently are the same as Ordinary Income (although this hasn’t always been the case).

If you have Restricted Stock Units (RSUs), which are often awarded to workers in the tech industry, then you may receive a separate 1098-B for your RSUs.

Don’t fret if you accidentally trashed your 1098-B and 1099-INT from your bank; you can often just log into your bank account and retrieve the documents yourself or contact your bank for replacements.

Education and Student Loan Documents

Education is a gift that keeps on giving. Perhaps that’s why so many people are still paying for their education years later! Whether you are currently in school or just paying the tab for it, you should receive important tax paperwork to document the money paid for education.

Thankfully, like the other 1098 statements above, your educational 1098(s) are relatively simple to read. Often there will only be one field in each relevant to your taxes (tuition or interest paid). The student loan interest deduction is relatively simple to do on your taxes.

On the other hand, tuition deductions are so complicated that we’ll have to cover them in another article. Basically you have to make a decision about which kind of tuition credit you want to use this year, and the decisions you make this year can affect your options in future tax years. Don’t say we didn’t warn you, but you can contact us for guidance.

If you’re missing your 1098-T, you can contact your college for a replacement. For a 1098-E, contact your student loan lender. Usually, taxpayers only receive one or the other, but if you graduated last year then you may receive both a 1098-T and a 1098-E.

TL;DR: While it’s usually not too hard to obtain your W-2, K-1, 1098s, and 1099s, don’t wait until the last minute to collect your tax documents! We’ll say it again, don’t wait until the last minute to collect your tax documents! If you lose some of these documents, depending on which document it is you can contact your employer, your organization, your college, or the relevant banking institution for a replacement. These institutions are required to provide these documents to you. Need help with your taxes this season? Book a session with one of our accountants through the Let’s Chat page!