With COVID upon us and tax season coming up, you may be wondering if you can get any tax money back for all those dizzyingly exorbitant medical expenses you may have had. The answer, as it is with so many tax questions, is “it depends.”

The deductibility of your medical expenses depends on:

- Whether your medical expenses exceed the “AGI floor” (more on that below)

- Whether you itemize your deductions

- The types of medical expense(s) you have incurred

We’ll tell you right now that, sadly, unless you’ve had a major medical expense in 2020, you will likely be unable to deduct any medical expenses at all.

Note that you may be able to make tax-exempt contributions to various schemes, such as a Health Savings Account (HSA), Flex Spending Account (FSA), or Health Reimbursement Account (HRA).

Your Medical Expenses Must Exceed Your AGI Floor

Though Congress made the decision to allow medical expenses to be deductible, it has been legislated that, basically, only exorbitant medical expenses are deductible. We won’t get into whether or not this restriction is wise, but will tell you how it works.

First, take a look at your adjusted gross income, or AGI. For simplicity’s sake, let’s say your AGI is $60,000. For 2020, only medical expenses exceeding 7.5% of your AGI are deductible. This means that the first $4,500 of medical expenses are not deductible at all — not even in the slightest. Unless they were infected by COVID, a great many Americans did not spend more than 7.5% of their AGI on medical expenses in 2020. This may be due to insurance stepping in to defray expenses, or because so many of us avoid going to the doctor in the first place because there’s no telling how much it will cost!

(On the subject of COVID: Yes, you are able to deduct out-of-pocket COVID expenses as long as these expenses qualify by all other standards for this deduction.)

We at TL;DR understand that having an AGI floor provides Americans the dubious incentive that it’s better to try to “lump together” your medical expenses into one year rather than spreading them out. We can’t advise that you delay trips to the doctor, but if you have major medical expenses in 2021, it could help to fill as many of your prescriptions as you can before the year ends.

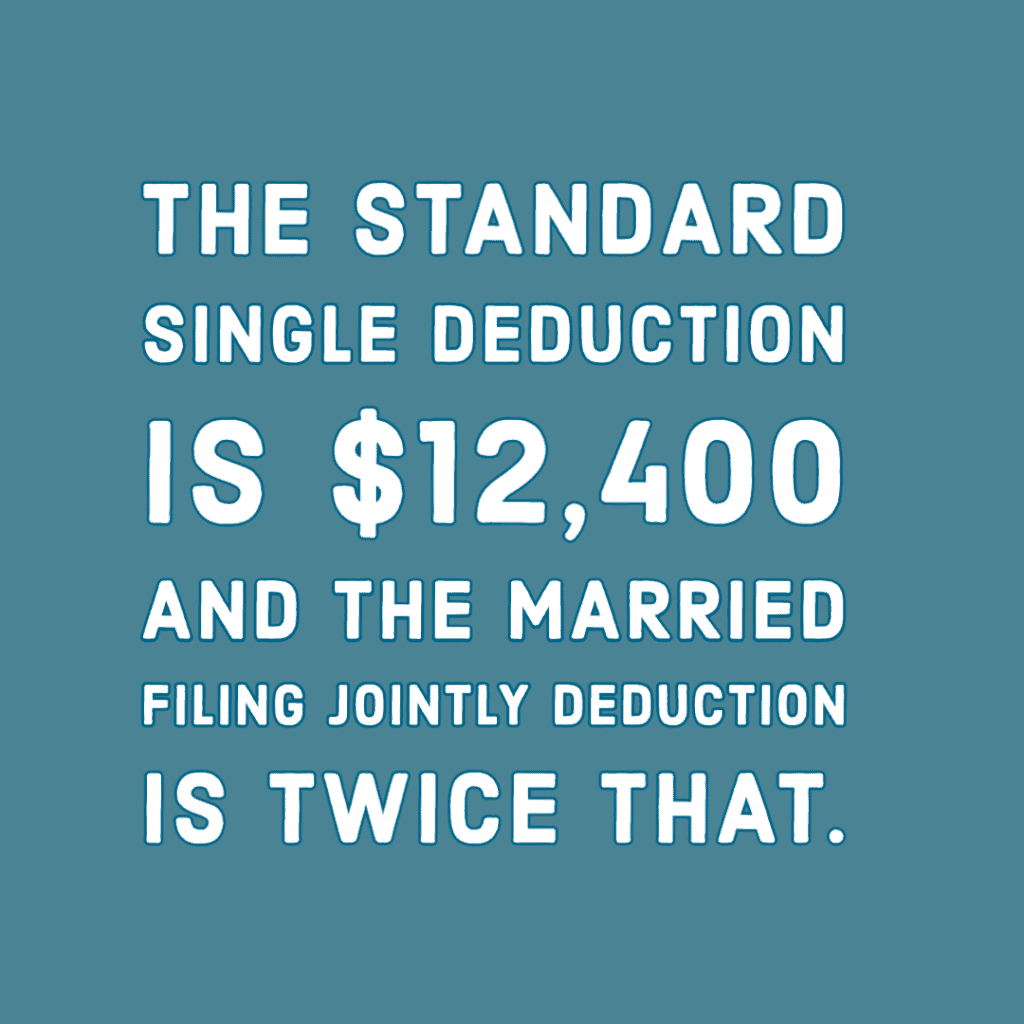

You Must Itemize Your Deductions

Do you expect to itemize your deductions for 2020? If not, you cannot take a medical expense deduction, full stop. For reference, the standard Single deduction is $12,400 and the Married Filing Jointly deduction is twice that. This is due to the Tax Cuts and Jobs Act (TCJA) increasing deductions quite a bit to offset the elimination of exemptions.

Due to the very popular mortgage interest deduction, home ownership is one of the main factors that will lead a taxpayer to itemize. Other major factors that could lead to itemization include state and local taxes paid (which can be estimated using AGI), charitable donation deductions, and, of course, medical expenses.

If you used the standard deduction for your 2019 taxes, your medical expenses would probably have to be quite large to make it worth itemizing for 2020.

Your Medical Expenses Must Be Eligible

Depending on the kinds of medical expenses you experienced in 2020, it’s possible that only some of your expenses are deductible. Here’s a quote straight from the IRS:

Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.

As you might expect, paying “doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners” is eligible, although you can check this more specific list to see if a particular practice in question has been identified as eligible. Some more popular treatments such as Acupuncture and Chiropractor visits can be eligible.

Of course, the sole fact that a treatment is tax deductible could still mean that you bear the brunt of the expense — deductibility is not the same thing as being covered by insurance.

Hospital stays and prescription drugs are eligible, as well as expenses to cover items meant to assist taxpayers who are living with a disability (glasses, hearing aids, crutches, and wheelchairs, for instance). Notable expenses that are expressly not deductible include cosmetic surgery, maternity clothes, and non-prescription drugs (except for insulin).

Important: If you are an employee and you pay a premium for your insurance, your premium is excluded from your income on your W-2. This explains why it is not deductible as part of the itemized medical expense deduction.

If you have any questions about whether your medical expenses are deductible, contact us!

TL;DR: There are three major hurdles to clear before you are able to claim medical expense deductions on your tax return. First, your expenses must exceed 7.5% of your AGI (2020). Second, you must itemize your deductions instead of claiming the standard deduction. Third, you can only claim eligible medical expenses though, thankfully, this eligibility is rather broad.