Gold Five: Stay on target.

Gold Leader: We're too close!

Gold Five: Stay on target!

~ Star Wars Episode IV: A New Hope

Targets are important: they help us to focus our energies on what’s truly important to us. Sure, you might not be blowing up the Death Star right now, but you’re probably focused on something just as important as interstellar combat: meeting your target salary.

Prefer to watch on YouTube? Press play:

Let’s talk through this process step-by-step.

Step One: Determine your Average Session Fee

Before you start plotting how to hit your target salary, figure out your Average Session Fee, or ASF.

Determining your ASF can clue you in to how close you are to meeting your financial goals, or how much you need to tweak your session rates to be able to do so.

Step Two: Put Together Your Expenses

One of the golden rules of accounting is: Revenue - Expense = Net Income. As mentioned before, your net income is eventually going to be split into a few different categories based on your needs: savings for tax payments, savings for retirement, and distributions / pay.

So, to get your revenue, subtract your expenses, and then you divide the rest into a few different categories, one of which is your salary. It might feel harsh that your revenue gets cut away, and cut away, and cut away, and then what little is left over is supposed to pay for your rent, food, childcare if you have children, pet expenses if you have pets, and all the other things you must pay. You might even feel like disposable income is a distant dream.

What we can tell you is that making workable plans for your income is intended to make all of this better. If you’re not surprised (or less surprised) about your financial situation, then you are better able to make the best of what you have.

If you have accounting software, now is a good time to pull a Profit & Loss statement for the past year and take a look at what kinds of expenses you see. Some expenses are fixed at the same price every month, like rent often is. Other expenses like supplies are variable and will change quite a bit. There are also special kinds of variable expenses that change based on the time of year it is. For our sake, we’ll call these expenses cyclical or seasonal. Gas heating would be a good example of a seasonal expense.

Seasonal expenses are a good reason to look at a whole year of expenses if it’s available. If you budget your gas expenses based only on the month of April, you might bust your budget every winter month. Averaging out seasonal expenses for your budget will mean that your under-budget and over-budget months will hopefully cancel each other out.

Step Three: Set Your Target Salary

Now that you have a handle of your income based on your Average Session Fee, as well as your expenses based on past experience and/or careful estimates, it’s time to play with different salary amounts to see where they leave you.

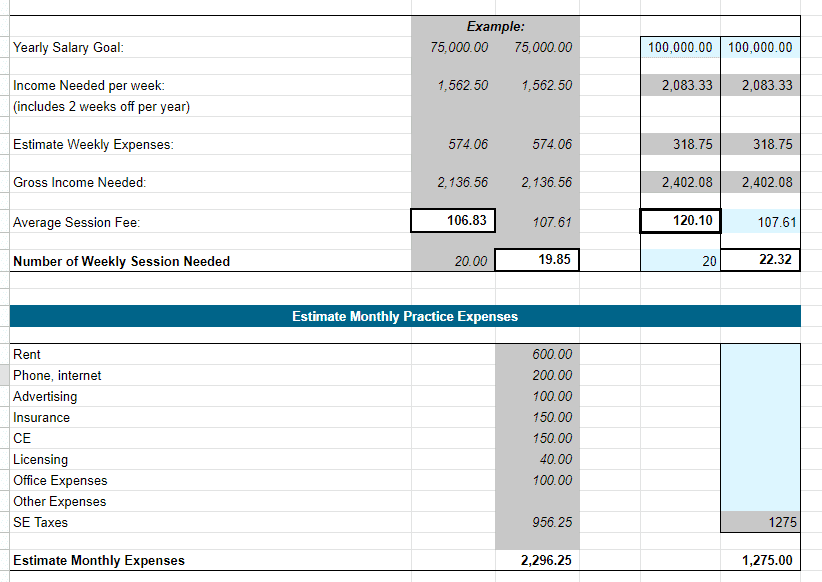

Take a look at this Salary Calculation:

The purpose of this spreadsheet is to help you determine how many sessions you must run per week in order to make the salary you desire, given the expense amounts you fill in.

Now is a good time to think about what you are able to control:

- You have complete control over your target salary, but it behooves you to be realistic about it.

- You can control your session fees, but that will have an affect on how many and what kinds of clients will be able to seek your services.

- In the same vein, you have some control over the number of sessions you run per week. Namely, you might be able to reduce your sessions per week depending on your clients but increasing them depends on how well you can market your services as well as demand.

- You also have control over how many weeks you work in a year. That said, as you know there will be clients who feel they need extra help during the time you might want to take off (the holiday season). Don’t burn yourself out — your clients need you.

- To some extent you can control many of your expenses. You can move to a smaller office or run your business out of your home. Other expenses, like licensure expenses and taxes, are not under your control.

Based on the aspects of your business over which you have control, take a hard look at the numbers and set a realistic target salary.

This article finishes our trilogy on Therapy Practice Metrics, and we hope it brings you a new hope to take charge of your finances. If all of these metrics are intimidating, just remember that fear is the path to the dark side… and give us a call, we’ve got your back!

TL;DR: To set your target salary, first determine your Average Session Fee (ASF). Second, tally up your expenses (if available; actual numbers are better than estimates). Then it’s time to set your salary based on the factors of your business that you can control. Stay on target!