Are you a corporation? Do you find yourself breathing cash flow and snacking on accounts receivable, and was your birth recorded on your Articles of Incorporation?

We’re just kidding; no living breathing person is a corporation (if you take away the living breathing part, it’s a different story). Regardless, you might be doing business as a corporation, and you might be the only person who works for this corporation. If this is the case, you are probably a Single-Member Limited Liability Corporation (SMLLC).

Note: A married couple can also count as a single member for an SMLLC depending on the state you live in.

Let’s cover three important questions you might have as an owner of an SMLLC:

- If you work for your SMLLC, are you considered an employee?

- Where and how do you report your income tax?

- Will you be responsible for state income tax?

Are You an Employee?

The answer to this question is: Probably not.

Unless you have elected to be taxed as an S-Corporation, the owner of an SMLLC is not on the payroll and not a W-2 employee. This is kind of a good thing because having payroll adds quite a lot of complexity to the operation of your business.

If you at some point hire an employee, you will need to register with the State in which the employee works (which may be a different state from your state), and you must fill out all applicable forms and be sure that you are following state law. For example, there are legally mandated breaks in Washington State with which you must comply. Also, there are restrictions on how low a salary you can pay to someone who is not paid by the hour (also known as an exempt employee).

If you decide to become an S-Corporation, you automatically become an employee of your own business. This means, yes, all of the above applies even if you’re the only employee.

Where to Report Your Income Tax

As a Single Member LLC (assuming you are not an S-Corporation), you will report your corporate income on Schedule C of your 1040. Even though it’s a corporation, your business will not use a corporate tax Form 1120. This is because an SMLLC is a disregarded entity, a business entity that does not file its own taxes.

Disregarded entities report their income on your 1040. So, the entity is disregarded for tax purposes but you still get liability protection as long as you respect the corporate veil. “Respecting the corporate veil” means treating your business as a business and, among other things, not mixing business and personal expenses.

Many business owners don’t hesitate to use their corporate credit card to shop at a grocery store. We do not recommend this. Unless your grocery store shopping is directly related to your line of business (say, if you have a catering business), it’s best to use your personal card for it. Have a look at our article on reasonable, ordinary, and necessary business expenses.

State Income Tax Considerations

Does your SMLLC have to file state income tax? We’ll talk about Washington State specifically in this article, with the understanding that different states have different state laws about income tax.

Washington State has no personal state income tax, which is why you don’t have to file a WA-specific form with your 1040.

However, WA does have a state business income tax. This tax is reported to the Washington State Department of Revenue (WA DoR), and it’s called Business & Occupation (B&O) tax.

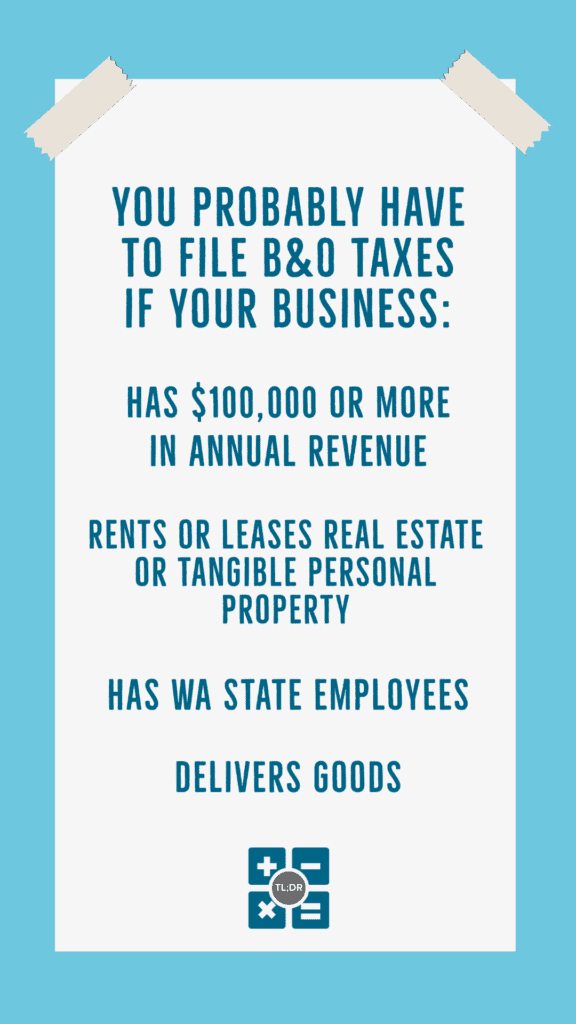

You probably have to file B&O taxes if your business:

- Has $100,000 or more in annual revenue

- Rents or leases real estate or tangible personal property

- Has WA State employees

- Delivers goods

Your filing frequency with the Department of Revenue will depend on your annual revenue. Filing may be annual, quarterly, or monthly, and the Department of Revenue will tell you if you need to file more frequently. Note that if your income drops, you can contact the WA DoR to request a reduction in filing frequency.

Or if you want, you can always ask us to do your state filings for you. We can also handle your communications with state employment and taxing agencies and just give you the “Too Long; Didn’t Read” (TL;DR) version!

TL;DR: If you do business as a Single Member LLC (SMLLC) and you have not elected to be treated as an S-Corporation for tax purposes, you are not an employee of your business. You will be expected to file your business income on Schedule C of your personal 1040 because your SMLLC is considered a “disregarded entity” for tax purposes. However, you will need to file state income tax if you meet certain criteria, mainly if you make $100k or more in annual income. The WA Department of Revenue will tell you how often you need to file state Business & Occupation (B&O) taxes.