Do you sometimes find yourself sacrificing long-term success in order to serve urgent business needs? Sure, you’ll retire one day, but it’s not today. Today you need to pay your rent before they change the locks on you!

While this kind of behavior can keep you afloat in the short run, or maybe even a long time, it’s likely that you’ll end up wondering where all the money went. As you may have heard with personal budgeting, “pay yourself first.” Well, it turns out that this rule applies to business budgeting as well! Or more realistically we will advise this: “Pay the IRS and yourself first.”

In this article we’re going to cover our three most highly recommended “stashes” in which to sock away your business net income: Taxes, Retirement, and Vacation.

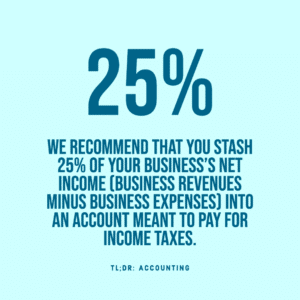

Stash One: 25% for Taxes

Let’s get the most obvious and disappointing point out of the way first. The IRS wants a cut of every dollar you earn. Yes, it’s frustratingly un-fun for the government to reach into your wallet and start yanking out bills (metaphorically we hope). None of us have direct power to change this, although we do have the power to vote for representatives who do have this kind of power.

We recommend that you stash 25% of your business’s net income (business revenues minus business expenses) into an account meant to pay for income taxes. This is a lot of money to be sure, and we understand that it may take an adjustment to get yourself into a position where you can part with this much money every month.

But you’re going to have to pay this money to the IRS regardless of whether it’s earmarked or set aside in advance. If it turns out that you put a bit too much money away, then you can enjoy some flexibility! This is much better than the alternative of finding creative ways to locate enough cash to pay your taxes four times a year.

Stash Two: 10% for Retirement

We assume that most people don’t want to work until the day they die. Is that true? Even if you feel like you do want to work for your entire life, there’s a chance that you may change your mind. Or that you may one day be unable to work, or to work as much as before, due to a disability.

But beyond all that, retirement can be a time in your life where you accomplish the kinds of personal goals that don’t involve income. Did you always want to visit the Australia Zoo, established by the late Steve Irwin? Maybe you would love to one day chat over tea with a Buddhist monk in Thailand, or warm your cold bones with some delicious spiced wine on a winter day in Bavaria! [We’re aware that COVID is currently getting in the way of international travel, but maybe it will be safe to travel again by the time you retire.]

When it comes to plane tickets, zoo entry fees, and booking a night at an impossibly cute Bavarian villa, Social Security probably isn’t going to cut it. We recommend stashing 10% of your business net income for your long-term dreams.

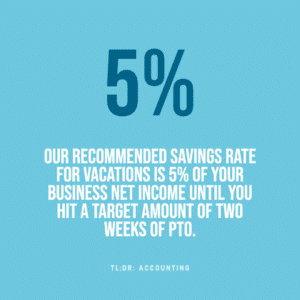

Stash Three: 5% for Vacations/PTO

We at TL;DR Accounting fully understand that you should in no way put off all of your dreams, desires, and fun until retirement! You might be surprised at the number of different, fun, and safe ways there are to rest and relax in your area. Summertime is on its way, which opens the door to all sorts of outside activities.

If you have a compromised immune system or otherwise feel unsafe around COVID, this is no reason to stop stashing money away. It is unfortunate that so many of us are so limited in our options for spending our vacations, but if you save money consistently, you can have a super-amazing luxury vacation further down the line.

Our recommended savings rate for vacations is 5% of your business net income until you hit a target amount of two weeks of PTO. What we mean is that you will still be able to pay yourself the same amount of money even if you take two weeks of time off.

We’ll wrap up with a thought exercise: You may be really good at running your business, but are you happy? There are so many things to keep track of as a small business owner, even beyond having to save up for your tax liability and your own retirement.

If you’re not feeling like you want to be a business owner anymore, there’s nothing wrong with finding a job and hanging up your entrepreneur’s hat (we’re imagining a dapper steampunk tophat with shiny brass gears).

TL;DR: Don’t fall into the trap of spending all your money on current business needs. As a small business owner, you are the one who has to save up for your own taxes (because withholding is for employees), and you have to stash money aside for retirement (which may involve setting up new accounts). Your next vacation may be some of the best money you’ve ever spent, so don’t let it slip away. If you need help planning for all of this, drop us a line! The future is sooner than you think.