If you have someone working in your home for pay, you may have to pay household worker taxes, often called “nanny taxes” (we’ll use the terms interchangeably). You may have heard horror stories about how complex nanny taxes are (and they certainly are). Nanny taxes are complex because you are putting yourself in the position of the employer of a nanny.

We’ll start off by determining whether you actually have to do nanny taxes in the first place. After that we’ll cover Federal and state requirements for becoming an employer, ending with a list of regular taxes you need to pay.

Do I Have to Pay the Nanny Tax?

We don’t like being the bearers of bad news, but if you have a nanny then you most likely have to pay nanny taxes. There are only a few legal ways to get around household employee taxes:

- If you pay your spouse, your child under 21, or your parent(s) to watch your kids, then you don’t owe nanny taxes for them. If you are married, then your spouse’s children under 21 and parent(s) also do not count for nanny taxes. If you are unsure of whether a child counts as your child (due to adoption, guardianship, or another situation), give us a call and we can help you understand the legal situation regarding nanny tax.

- If a household service provider is actually a freelancer, then you don’t have to pay the tax for that particular person. We’ve previously covered what it means to be an employee vs. a freelancer, but for the sake of this article we’ll use an example. A freelance lawn care worker who has agreed to cut your lawn every other week is not an employee if:

- They have substantial power over their own work schedule (don’t worry, you can change the contract to have them to mow every week, even on a particular day, and that still doesn’t change them into an employee).

- They use their own tools.

- They are substantially in control of how they do the work.

- Important note: Nannies are not freelancers, because you control when and how they do the work. Your nanny probably has set hours, and you get to control how they treat your children, probably in a way that approximates your parenting style. Because you control how and when the nanny works, the nanny is your employee.

Unfortunately, you are still “on the hook” to pay nanny taxes even if your nanny works through an agency, though some nanny agencies will assist you with paying nanny taxes.

Before moving on, let’s clear the air of something important. It can be very tempting to pay your nanny “under the table” (i.e. not reporting their wages). The temptations are strong: it would reduce the tax and filing burdens for both you and your nanny. Still, don’t pay your nanny “under the table:” this is illegal. If your nanny asks or strongly hints that you pay them under the table, it’s your responsibility to decline the suggestion and instead do things by the book.

In short, if you have a nanny (as opposed to a different kind of household worker), you most likely have to pay nanny taxes. With other household workers it depends on how much control they have over their schedule, how they perform their work, and if they provide services to other clients.

Our recommendation is that you go with a nanny service to take care of your payroll obligations. While you can do it on your own and we do outline instructions below, it is easy to mess up any one of these steps. You should google “nanny payroll services” to find a service provider.

Now let’s move on to the initial setup for you to become your nanny’s employer.

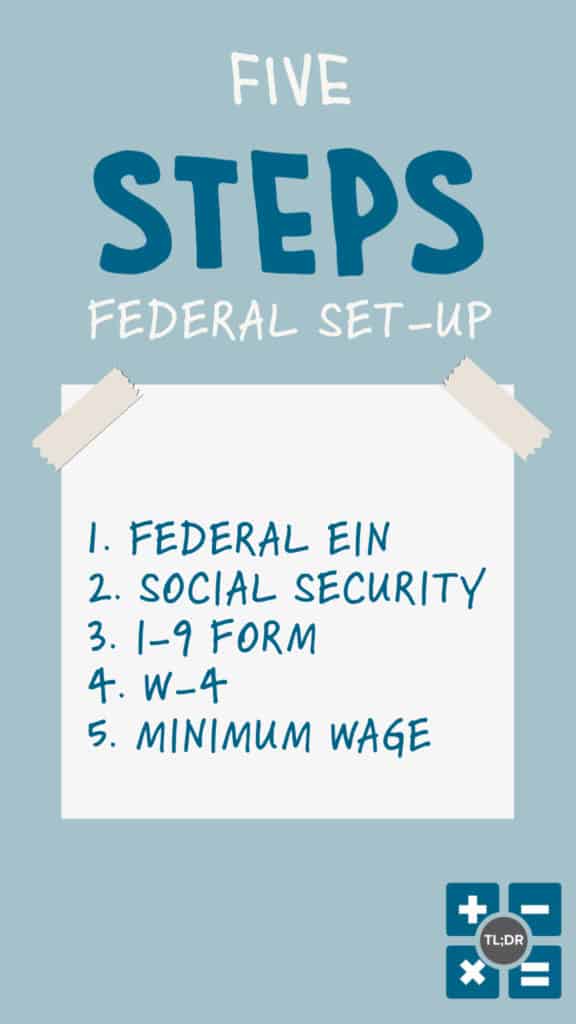

Initial Set-Up: Federal Requirements

With a heading like that, aren’t you excited? Right, we get it, we’re called TL;DR: Accounting because we’re supposed to give you the short version of everything. Unfortunately there’s only so much we can do to shorten complicated laws like payroll regulations. Bear with us if you can (or if you can’t, just give us a call and we’ll figure it out for you and give you clear instructions to follow!).

If you pay your nanny more than $2200 in the year 2020, you will need to pay Federal income taxes on their wages. The good news is that this will qualify your nanny for unemployment benefits if they later find themselves out of work, and it also contributes their earnings towards their Social Security benefits they will get when they retire (Social Security will still be there when we all retire, right?).

Step 1: Get a Federal EIN

Since you are about to become an employer, you first need an Employer Identification Number (EIN). You can go here to follow the instructions and set yourself up. You can use your own name as the employer name, since you are employing the nanny to do work for you personally.

If you already have an EIN for yourself, great! You can check the box off right now. Make sure to keep track of your EIN; it’s an important number.

Important Note: If you have an incorporated small business with employees, don’t use your corporation’s EIN for your household nanny.

Step 2: Social Security registration

If you work or have worked as an employee, you have (hopefully) received a W-2 for your work shortly after the end of each year in which you worked. Now that you are an employer, it will be your job to provide a W-2 to your nanny. You can go here to register with the Social Security Administration. It’s good to do this now instead of waiting until the last minute because the process can take a few days.

Step 3: The I-9

The I-9 is a form created by the Department of Homeland Security (DHS) in order to prove that the nanny is legally eligible to work in the United States. This form is a legal requirement! You don’t have to file it anywhere; just keep it in a very safe place. While unlikely, it is possible that a DHS agent will show up at your door and ask to see this form, and you will be expected to provide it within a few days. Why not just have it ready ahead of time?

Step 4: The W-4

If you don’t remember what a W-4 is, it’s that form you fill out as a new employee to calculate your Federal withholding. Here is the Form W-4 (note that it has changed recently).

Step 5: Minimum Wage

Federal minimum wage is $7.25 per hour, Washington State minimum wage is $13.50 per hour, and Seattle minimum wage is $16.39 per hour. You must pay the highest minimum wage based on where your household is located.

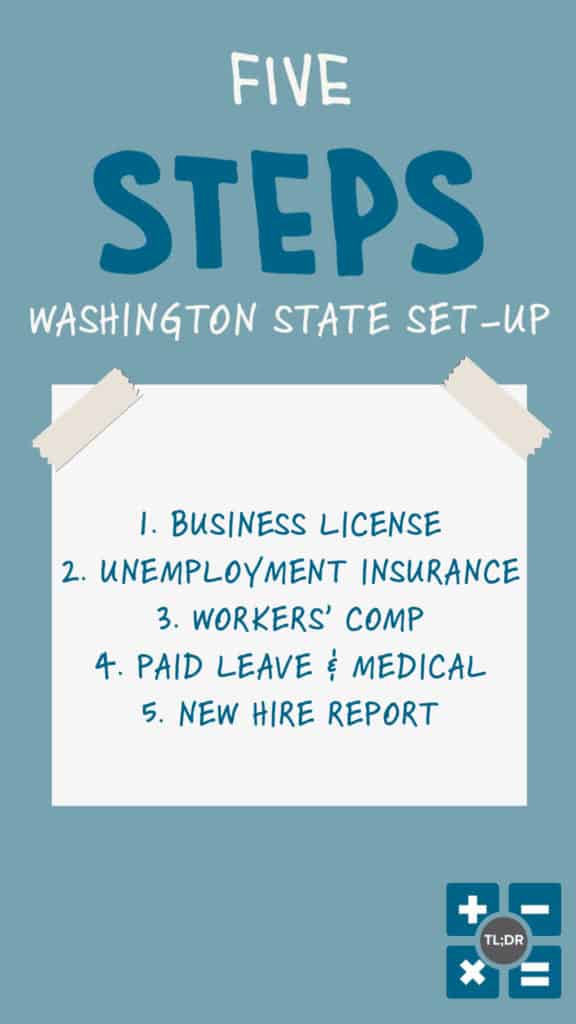

Initial Set-Up: Washington State Requirements

[Important note before we get started: These steps apply if your household is in Washington State.]

Step 1: Business License

You can go here to file a business application for Washington State. Yes, we agree that it’s a bit odd that you have to file a business application even if you’re an employee with a nanny to watch the kids while you’re at work. Regardless, it’s a requirement. If you’ve already filed a business license for yourself as a Sole Proprietor (see this article about entity types), you can skip down a bit.

Your business type for being a nanny employer will be Sole Proprietorship, regardless of whether you are married and/or live with a partner. Remember that you’re filing this in order to hire a person to work inside your home, so check only that box when it asks about the kinds of employees you will hire.

[Note: If you already have a Sole Proprietorship in your name, just check the box saying you will hire someone to work in your home in addition to any other boxes that are already checked.]

You can leave the EIN part blank if you don’t have one yet. You will get a UBI (Unified Business Identifier) from your state business application. This is also an important number to keep track of. Don’t let the name fool you, the Unified Business Identifier is used in tandem with several other business identifiers that you will need to remember.

Step 2: Register for Unemployment Insurance

Speaking of important numbers, registering in Washington will lead on to your application for unemployment benefits which will get you an Employment Security Department (ESD) number, another number to keep in a safe place. Your nanny is entitled to state unemployment benefits just like any other employee in Washington State. You can register with Secure Access Washington here in order to pay unemployment tax online.

Step 3: Workers’ Compensation

Ordinarily the next step in setting up a Washington State business is to apply for Workers’ Compensation benefits. This is only necessary if you have two or more household workers working 40+ hours per week on average.

Step 4: The Paid Family and Medical Leave Act

Next is the new Paid Family and Medical Leave act (PFML). You set up PFML reporting through the Secure Access Washington website here.

Step 5: New Hire Reporting

The final Washington State setup requirement is to report your new hire upon hiring a nanny. You can do this here.

That wasn’t too bad, right? No, actually it’s a lot of work. But it’s not like you have a choice here: these are all legal requirements.

Your Tax Obligations

Let’s list and define all the taxes that you must pay as a nanny’s employer:

- Federal Unemployment Tax Act (FUTA) tax: If there’s a quarter in which you pay your nanny more than $1,000, then you must withhold and pay FUTA. Let’s be real, at Washington State minimum wage that comes out to 74 hours per quarter, or about 6 hours per week. So yes, you are almost guaranteed to need to pay FUTA. If your nanny is your only employee, you can pay FUTA by filing Schedule H with your income taxes the following year.

- You are only required to pay FUTA on the first $7,000 of your nanny’s wages per year. If you change out your nanny during the year, the $7,000 resets and you have to pay FUTA again.

- FICA (Federal Insurance Contribution Act) tax: This is paid annually. Will you pay your nanny more than $2,000 this year? Most likely yes. You pay 7.65% of your nanny’s wages in FICA tax, and your nanny has her pay reduced by 7.65% to pay her portion. If you just have the one nanny as an employee, your FICA payment will be annual (unless you’re paying your nanny a king’s ransom).

- Washington State Unemployment Tax: This is filed quarterly, and the percentage varies. The Washington State ESD will tell you what your rate is after you create an account with them.

Whew, that was quite a lot of information! Seriously, we recommend hiring a nanny payroll service to do this for you. If you truly value a little bit of money over a lot of free time (or if you are genuinely interested in how all this works), then more power to you. Don’t hesitate to request help when you need it though.

How To Pay Nanny Taxes

You will need to report the above information on your personal tax return on Schedule H. When we work on a tax return, we ask for the W-2 for the nanny along with any tax payments made and unemployment taxes paid.

The best practice is to pay the payroll taxes in each quarter. If you don’t, these taxes will be due and added to your personal taxes owed on your 1040.

TL;DR: By hiring a nanny, you become an employer, which triggers federal, state, and local regulations as well as payroll taxes. We recommend that you work with a nanny payroll provider to file and pay these taxes for you. We will need this information for your personal tax return as well. Have any questions? You can reach out to us any time!