Is your income too high for a Roth IRA, but you want to enjoy the unique benefits of this special kind of retirement account?

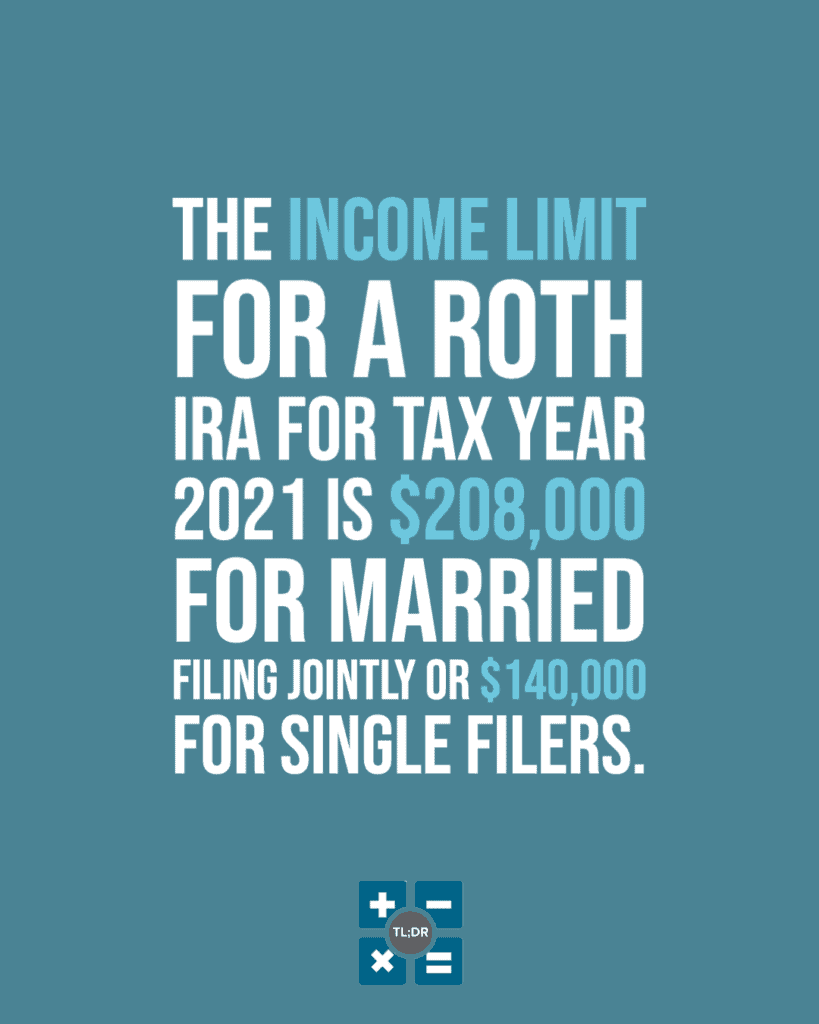

(Note: The income limit for a Roth IRA for the tax year 2021 is $208,000 for Married Filing Jointly or $140,000 for Single filers.)

There is a way to get the benefits of a Roth IRA even if you are a high-income earner. It does involve some tricky administrative work, though, so it is important to do it right.

How Does a Roth IRA Differ From a Traditional IRA?

The most significant difference between a Traditional IRA and a Roth IRA is when the money is taxed, but let’s get into the details:

An IRA is an Individual Retirement Account. Its purpose is for you to be able to save money for retirement in a tax-advantaged way whether or not you have an employee retirement account (hence the name, Individual). Your contributions grow tax-free, which means that your nest egg grows more quickly in a growing market.

A Traditional IRA is the more complex kind of IRA and involves more administrative paperwork. Traditional IRA funds are taxed when you take a distribution (when you pull money out of the account) depending on the basis in your Traditional IRA account.

Because Traditional IRA money is taxed when distributed, this means that (barring special circumstances) you can expect to pull the money out when you are of retirement age. If you expect your income to be lower at retirement age, a Traditional IRA is likely a good choice for you.

A Roth IRA, on the other hand, is simpler and involves you transferring money directly from your checking account into a retirement account. This money has already been taxed before hitting your checking account (if it was taxable income).

(Note that tax brackets can and do change over the course of decades, but we don’t know how or when.)

How to Make A Backdoor Roth Contribution

So you understand the basics of a Roth IRA and are now wondering how you could contribute money to one if your income is over the income cap.

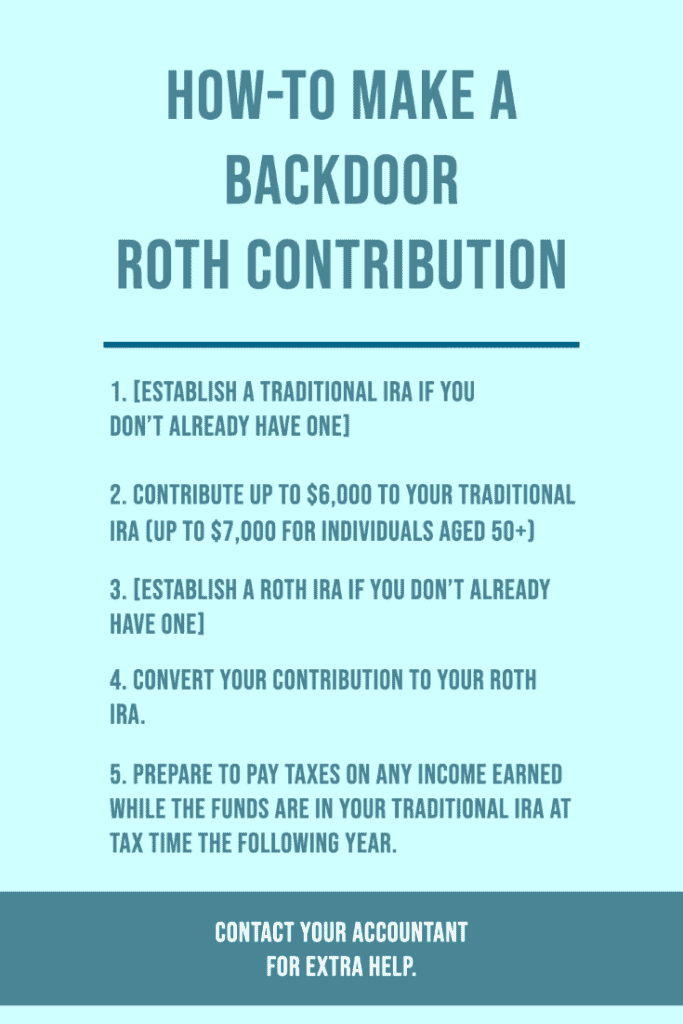

Well, here’s the step by step process:

- [Establish a Traditional IRA if you don’t already have one]

- Contribute up to $6,000 to your Traditional IRA (up to $7,000 for individuals aged 50+)

- [Establish a Roth IRA if you don’t already have one]

- Convert your contribution to your Roth IRA

- You can do a rollover contribution if your IRAs are with different providers — just make sure to finish the process within 60 days.

- There are other options for transfers — contact your IRA provider for details.

- It is best to convert the money to your Roth IRA in the same year as your initial Traditional IRA contribution.

- Prepare to pay taxes on any income earned while the funds are in your traditional IRA at tax time the following year. You also might owe taxes on the contribution to the Traditional IRA if you took a tax deduction for it. This is important because the money went into your Traditional IRA tax-free and it must be taxed as a side effect of converting it to a Roth IRA contribution.

The whole process is as simple as setting up two separate retirement accounts, estimating your conversion tax burden, and ensuring you have money saved up to pay the tax burden if necessary. (Right, so it’s not actually that simple.)

What to Expect After Setting Up Your Backdoor Roth

Once everything is in place, you can expect to receive the below documents during the following year:

- Form 5498 detailing IRA contributions you have made

- Form 1099-R showing your distribution from your Traditional IRA

You will also need to file a Form 8606 to send with your 1040 tax the following year. Form 8606 is appropriately called Nondeductible IRAs. This form is necessary because your Traditional IRA contribution that you later converted into a Roth IRA contribution changed from tax-deductible to non-deductible at the time of conversion.

Bonus: Is a Backdoor Roth IRA Worth It?

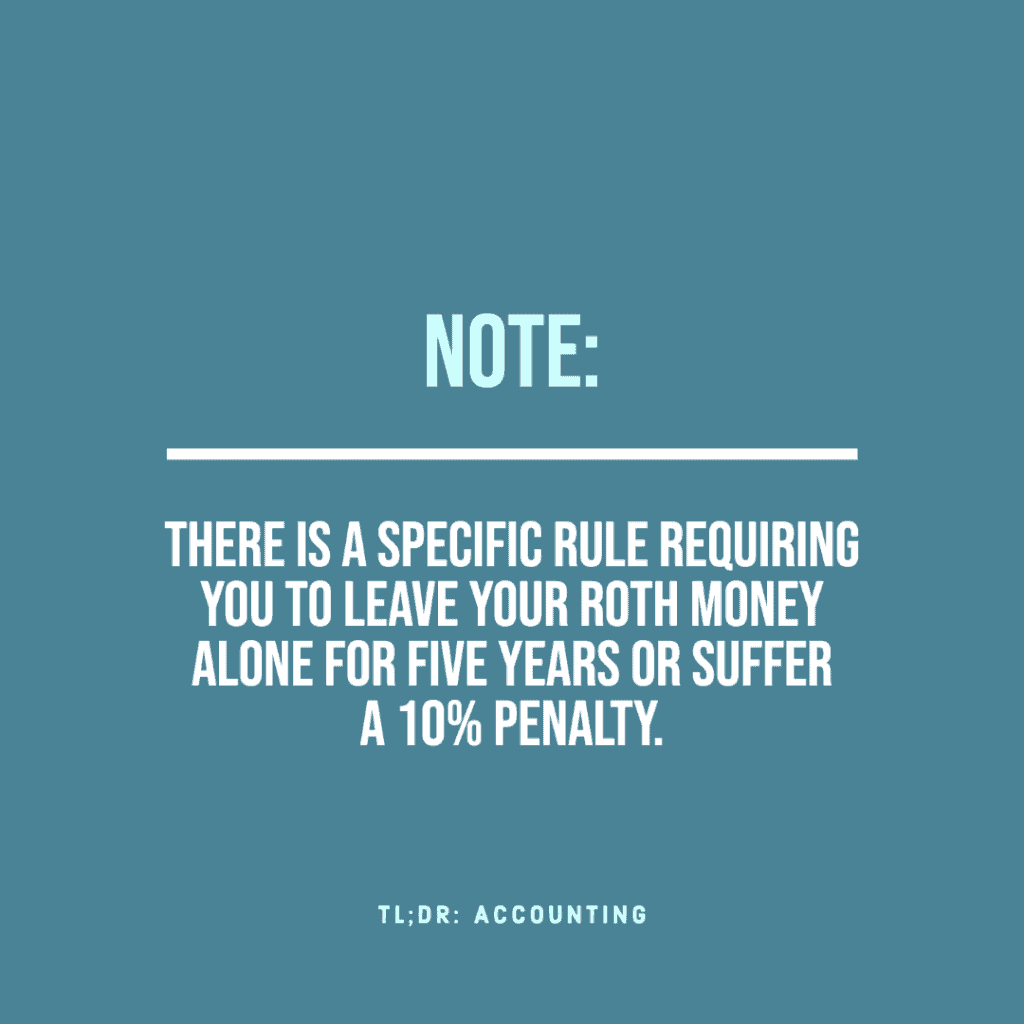

We have already discussed whether a Roth IRA itself is worth it, but there is an additional consideration to determine whether a Backdoor Roth specifically is worth the extra fuss. There is a specific rule requiring you to leave your Roth money alone for five years or suffer a 10% penalty. This rule matters if you are aged 54 or older, because you must be age 59 ½ to pull money from a Roth IRA penalty-free anyway (barring certain exceptions).

TL;DR: If you want to enjoy the benefits of a Roth IRA, don’t let those pesky income limitations stop you! A Roth IRA is a retirement account where the funds have already been taxed. To set up a Backdoor Roth, you must establish two IRA accounts, one Traditional and one Roth, then contribute money to the Traditional account and convert that money into the Roth account. You will receive a Form 5498 and a Form 1099-R after year-end, and you must file a Form 8606 with your 1040. Whether or not a Roth IRA is right for you depends on many different factors. Contact us and we can evaluate your specific situation.