Did you recently close on a house? Congratulations, you may qualify for some additional tax deductions!

(Oh, and congrats on buying the house too of course!)

Now that you’re the owner of a new (or new-to-you) home, there are important considerations to keep in mind when it comes to the tax implications of owning a house.

Two of the biggest recurring tax-deductible expenses for homeowners are mortgage interest expenses and real estate taxes. But depending on your tax situation, you may not save any tax dollars on these expenses. It depends on whether you itemize your deductions, as well as a potential cap on your mortgage interest deductions, and what you may spend on remodeling.

Standard vs. Itemized Tax Deductions

Let’s say you’re out looking for raspberries, and you approach a peculiar raspberry stand. The woman behind the counter tells you to make a choice:

- You can take a partially pre-filled basket and immediately leave with it, or

- You can grab an empty basket and try to fill it with as many berries as you can before sundown

What would you do?

This is similar to deciding between the standard deduction vs. itemized deductions. Thankfully when it comes to doing your taxes, you can pick all your berries and then compare your you-pick basket to the standard basket before choosing which one to take (naturally you’d take the bigger basket, right?).

Now, this metaphor also illustrates a shortcoming of homeowner itemized deductions (which you would likely put on Schedule A of your tax return). If you don’t have many other items to put into your you-pick basket of itemized deductions, you might as well just pick the standard basket regardless, in which case you may get no tax benefit at all from owning a home for the current tax year.

[Important note: We said “the current tax year” above because you’ll likely get a benefit later. If you sell your home for more than you bought it for, which is how things generally work nowadays, a large portion of the gain on the sale — or perhaps the entire amount — will be excluded from your income for tax purposes. In other words, you can make quite a sum on a home sale and pay zero tax on the profits!]

Homeowner Itemized Deductions Limitations

If you itemize your deductions on your 1040 tax return, you’ll likely get a substantial tax benefit out of owning your home. Both mortgage interest and real estate tax (also known as property tax) can pair with charitable contributions to make a potentially substantial trio of Schedule A tax deductions.

Note that there are separate caps on the maximum amount you can deduct for mortgage interest and for real estate tax:

- There are multiple limits on the mortgage interest deduction:

- If you don’t use all of your mortgage funds to “buy, build, or substantially improve the home securing the loan,” you may lose some or all of the deduction.

- For loans made after 1987 but before 12/15/2017, you can only deduct the interest on $1 million of debt (married filing jointly) or $500,000 (other filers).

- For loans made after 12/15/2017, the limit mentioned in item b drops to $750k / $375k.

- If the total principal of all the loans on a house exceeds the fair market of the home (i.e. the taxpayer is “underwater on the home”), the deduction is also limited.

- According to the IRS: “As an individual, your deduction of state and local income, sales, and property taxes is limited to a combined total deduction of $10,000 ($5,000 if married filing separately).”

Home Remodel Tax Deductions

We’ll start off with the bad news about home remodels: Home remodeling expenses are generally not tax deductible. However, the sales tax on remodeling expenses is deductible as long as you keep in mind the $10k annual limit on combined state and local tax deductions we mentioned above.

Additionally, the mortgage interest on home remodeling loans is generally deductible as an itemized deduction, subject to the same limitations mentioned above (the additional principal on a remodel loan may put your total home loans above the limit). Note that the IRS phrasing above is “buy, build, or substantially improve.”

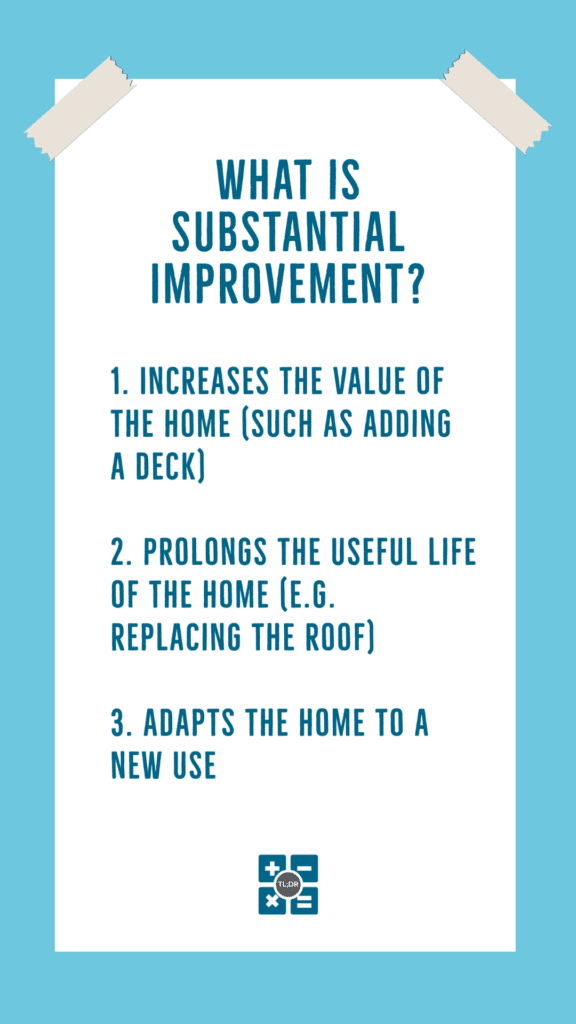

If you’re wondering what the IRS would consider a substantial improvement, just make sure that your remodel does one or more of the following:

- Increases the value of the home (such as adding a deck)

- Prolongs the useful life of the home (e.g. replacing the roof)

- Adapts the home to a new use

So if you’re feeling handy, call the bank and grab that toolbox!

TL;DR: If you take the standard deduction on your 1040, you may not get any current-year tax benefit from owning a home (though there are exceptions, such as the home office deduction for self-employed taxpayers). If you itemize, note that your mortgage interest deduction and property tax deductions might be capped. As long as you stay within these caps, you can take tax deductions on home remodel sales tax and remodel loan mortgage interest.