You probably have overarching goals for your small business, regardless of how often you revisit them or think about them. You want to provide a good or service to the world in your own special way. Whether you are healing trauma, exhibiting art, or feeding people pancakes, your business is more likely to succeed if you have focused goals.

But what are your goals for yourself? More specifically, what are your goals regarding:

1. Your own time off

2. Having money available to pay taxes

3. Growth of your business

4. Your own retirement

Providing For Your Own Time Off

As a business owner, you have achieved the enviable honor of Being Your Own Boss! We know that this comes with a lot of stress and worry.

You have the freedom to take time off whenever you like, as well as the responsibility to only take time off when it won’t hurt your business in the long run. If you lose a bit of business in the short run, well, that’s what PTO savings are for.

We recommend that, throughout the year, you save up enough money to provide 2 weeks of annual PTO for yourself. If you’re an S-Corporation owner, this is rather simple: Just save up 2 weeks’ worth of salary. For owners of other types of entities, think of the kinds of obligations you will be responsible for even if you don’t do any work. Think rent, employee pay, and things of that nature.

Establishing Tax Savings

You should be saving for taxes every month. Yes, we know that estimated taxes are only due four times a year. But come tax time, wouldn’t it be nice to just smile and send the money along rather than trying to see what you can “cut back on” in order to pay the IRS on time?

As you know, if you’re unable to pay the IRS on time, you will likely have to pay penalties and interest on your tax debt. Set yourself up to pay less money on time rather than paying more money after it’s due.

Growing Your Business

You’ve heard of the phrase “growing pains,” right? Regardless of how you grow your business, it’s probably not going to go perfectly. The key is to do your best to ensure that the things that don’t go perfectly are not so problematic that they sink your whole operation!

What’s the best way to keep your cash-hungry business from starving while trying to grow? Savings! That’s right, in addition to all the other kinds of savings you have (for taxes, retirement, and time off), it’s important to save up money before you grow your business. You will thank yourself later.

The kinds of major cash outlays that you may face when growing could include:

- Hiring employees (this can be more expensive than you might think)

- Training new hires

- Marketing

- Expanding your office space

- (For manufacturing businesses) Buying heavy equipment

Saving For Your Own Retirement

We hope that you’re not expecting Social Security to provide a comfortable standard of living when you reach whatever the retirement age will be. Without getting too deep into it, Social Security started when the working population vastly exceeded the retirement-age population. If that ever happens again it’s going to be long after we all retire.

[For the curious, the Social Security Administration has this handy-dandy chart. In 1945 there were 42 workers for each beneficiary. In 2010 that number sunk below 3. Yes, three.]

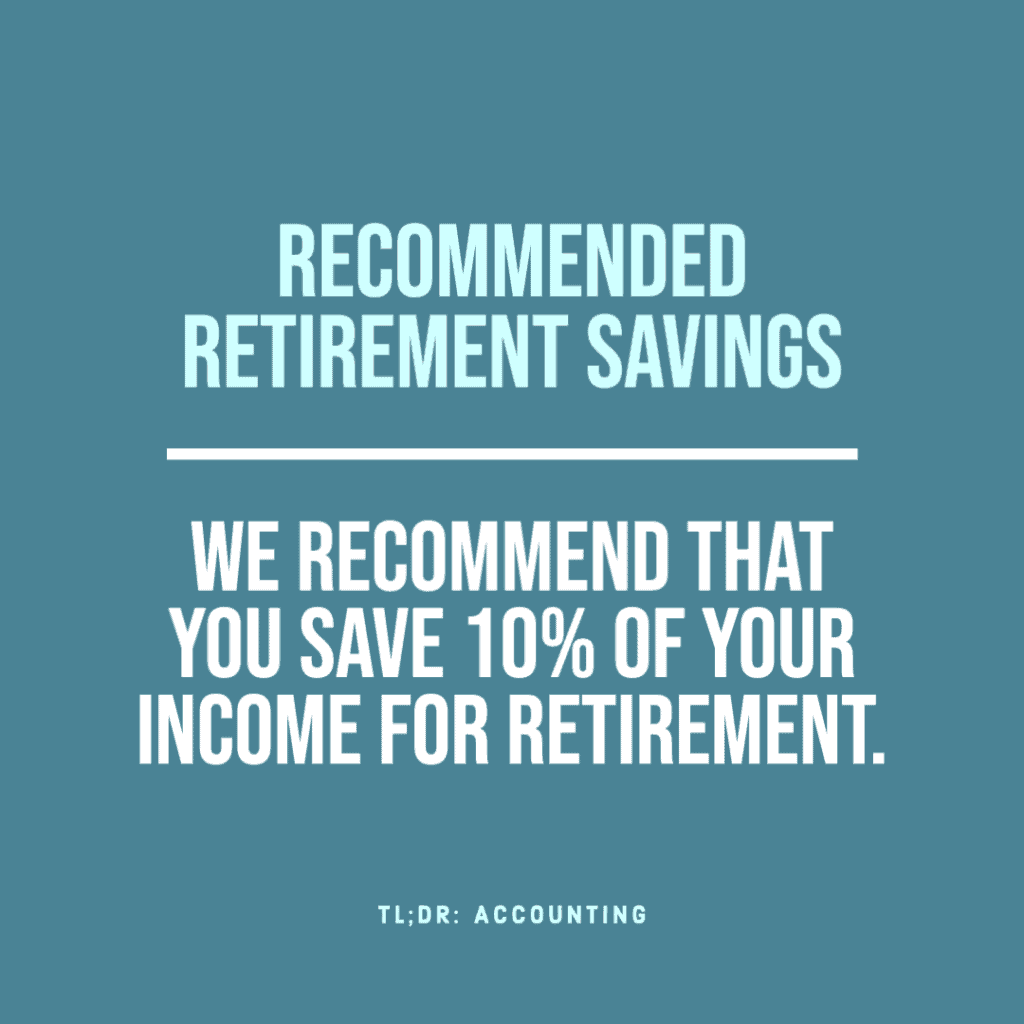

In short, relying on the Federal Government to pay your way through your golden years is a losing proposition. Because of this, it behooves you to pull some money off the top of your profits and put it into a personal retirement account. We recommend that you save 10% of your income for retirement.

We don’t have to tell you that it’s better to have saved an unnecessarily large amount of cash than it is to come up short at age 73.

TL;DR: We recommend that you establish savings for your personal and business goals, both short-term and long-term. Short-term goals could include saving up for a vacation (personal) or income taxes (business). Long-term goals would be socking away money to grow your business and building up your personal retirement stash. If you need help steering your business and personal goals, we’re happy to help set you on the right track. Schedule an appointment with one of our accountants here.