Do you remember that 1998 New Radicals pop song called “You Only Get What You Give?” We’re as surprised as you are that the song isn’t about S-Corporation basis. Regardless, it’s “basically” how basis works.

Your S-Corporation basis is your individual equity in the S-Corporation. When you contribute funds or other property into an S-Corporation, your basis increases. When you pull income out of your S-Corporation, your basis in the S-Corporation decreases. Often different shareholders in an S-Corporation start with equal basis amounts, but each shareholder’s basis can diverge through the life of the business.

In this article we’ll cover why basis matters, why it matters whether a distribution is a dividend, and the importance of calculating your basis annually.

Why Does Basis Matter?

S-Corporation basis matters because it has everything to do with the taxability of the money you receive from your business:

- If the money you receive from a non-dividend distribution is less than your rolling basis in the company, the distribution is not taxable.

- If you receive non-dividend distributions exceeding your S-Corporation basis, any amount exceeding your basis is taxable as a capital gain.

- Most of the time, this will be a long-term capital gain which is taxed at up to 20% depending on your income.

- If you take a distribution exceeding your basis within a year of your investment in the S-Corporation, then you risk triggering a short-term capital gain at a rate equal to your ordinary income, up to 37%!

In short, taking money from an S-Corporation exceeding your basis is undesirable unless you absolutely have to do so, especially if it’s a quick turnaround. But how do you track the amount of your basis? We’ll get to that after a quick note about corporate dividends.

Dividend vs. Non-Dividend Distributions

You may have noticed that, so far, we’ve only talked about non-dividend distributions from your S-Corporation. It is rare for S-Corporation shareholders to take dividend distributions, because dividends are taxed twice: the corporation pays a tax on the dividends it pays to you, and each recipient pays an income tax on the dividends they receive.

Avoiding this double-taxation is one of the main reasons to have an S-Corporation instead of a “regular” C-Corporation. S-Corporations are “pass-through entities,” which means that their income can pass through to you without being taxed.

Importantly, while your S-Corporation will likely never have to pay its own taxes, you must still file your S-Corporation’s 1120S tax form annually. One of the main reasons the IRS wants you to file the 1120S is so you can show them your annual basis calculations. See how it all comes together?

How to Track Your S-Corporation’s Basis

If your taxes are not prepared by a professional, there’s a chance that you haven’t bothered to track your S-Corporation’s basis yet. You might intuitively know that you’ve taken less out of your corporation than you have contributed. Even in this case, we argue that it’s still better to calculate your basis as soon as possible because:

- The later you start tracking basis, the harder it’s going to be to get started. It’s a messy calculation, and unwinding years worth of transactions is going to be painful (or expensive) for you (or your future tax preparer) to do.

- It’s better to have your rolling basis calculated in advance, before you need to use the amount. If a shareholder leaves your S-Corporation, if you have to take a large distribution, or if the business sadly has to close, then it’s probably not going to be a great time to crack your knuckles and get into some very complicated and tedious tax calculations. Please, do yourself a favor and stay up on your basis, or pay someone (like us!) to do it for you.

Calculating Your Basis

Let’s get down to the calculations. Please understand that we’re simplifying things a bit here. Our goal is to get you to the point where you can converse with your tax professional on the finer points of basis calculations. If you’d like to do basis calculations yourself, you’re gonna need more information and training than a single blog post can provide!

Without further ado, here’s our “short version” of S-Corporation basis calculation:

- Your basis, and the basis of any other shareholder in the S-Corporation, cannot go below zero.

- Your starting basis is the total value of the property you used to buy the shares in the business. If you just contributed cash, then this calculation is simple. If you contributed property, then it’s a bit more complicated. Property is valued at either its adjusted basis or its fair market value, whichever is lower:

- The “un-adjusted” basis of the property is the price you paid for it. If it’s property that you’ve never used in a business, this is also your adjusted basis. If the property has been used in another business, then you must use its “adjusted” basis. Subtract depreciation, and adjust appropriately for any improvements, and treat the property’s salvage value as the bottom threshold of its basis.

- Fair market value is the price someone would pay you in an “arms-length transaction” to buy the item. That is to say, if you sold the item on eBay or Craigslist to a random person you never met before, what would they pay you? This is much easier to find than it used to be thanks to the power of the internet!

- Don’t forget to choose the lower of adjusted basis or market value to figure the number you will be adding to your S-Corporation basis.

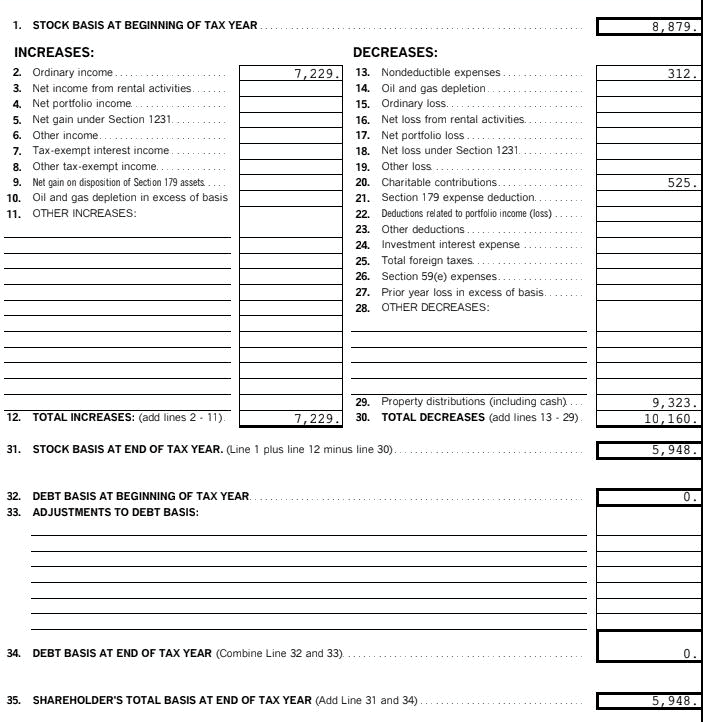

- Now that you have your starting basis, you must adjust it annually. Here’s our (oversimplified) list of what to do each year:

- Increase your basis by the amount of any contributions you made each year as above.

- Increase your basis by your share of the corporation’s net income.

- Decrease your basis by the amounts of non-dividend distributions you’ve taken from the S-Corporation.

- Decrease your basis by your share of the corporation’s net losses.

- Note again that your basis cannot go below zero. If distributions or losses ever exceed your basis, then contact your tax professional for help on what to do!

If you feel like running away screaming at this point, we understand. For most business owners it’s simply not time-efficient or cost-effective to do your own basis calculations. Please, allow us to help you!

Example:

TL;DR: Calculating your S-Corporation shareholder basis is as messy as it is necessary. To avoid serious tax consequences, make sure you never take more in distributions than you have in basis! We’re talking non-dividend distributions here of course, because dividend distributions are ill-advised for S-Corporations. To track your basis, start with your initial property contributions to your S-Corporation, then adjust annually for your personal contributions and share of gross income, then for your personal distributions and share of gross losses.

If it all becomes too much, we encourage you to reach out to one of our accountants to help!