We Help Therapists

Choose The Best Retirement Accounts

Are you a solo practice or do you have employees? Do you make too much money to contribute to a Roth IRA? Which accounts are tax deferred? These are the questions we'll help clarify for you in order to set your future self up for success.

Maximize Your Savings

How much money are you putting away for retirement each month? Are you maximizing contributions each year? Have you chosen the right accounts for yourself and employees? We'll coach you towards the best retirement planning for your unique situation.

Hit Your Financial Goals

Do you know how your professional and personal finances are tracking? Through quarterly 1:1 sessions, we'll help you brainstorm, track, and measure all aspects of your finances to hit your life goals faster.

Which retirement account is best for sole practice owners?

What should you consider when it comes to retirement planning?

Retirement planning can be stressful - are you taking advantage of the best tax savings & options available to you? Here are a few points to consider when finding the best account(s) for yourself and your practice.

Is it tax-deferred?

Many retirement accounts are tax-deferred, meaning that the money you put into them goes in untaxed and is taxed later (sometimes decades later). This may or may not make sense for your financial situation.

Does the employer contribute?

Many retirement accounts have employer contributions - voluntary and forced! Whether you own a private practice with employees, or you're an employee yourself, this is a critical factor to consider.

What are the contribution limits?

Retirement accounts have contribution limits, often with a catch-up provision for employees closer to retirement (based on age). It's important to stay within these limits to avoid hefty penalties.

What happens if you pull money out early?

Retirement accounts also differ regarding whether you can pull money out early, and what happens when you do. It's important to only put away an amount that you will not need in the near future to avoid penalties.

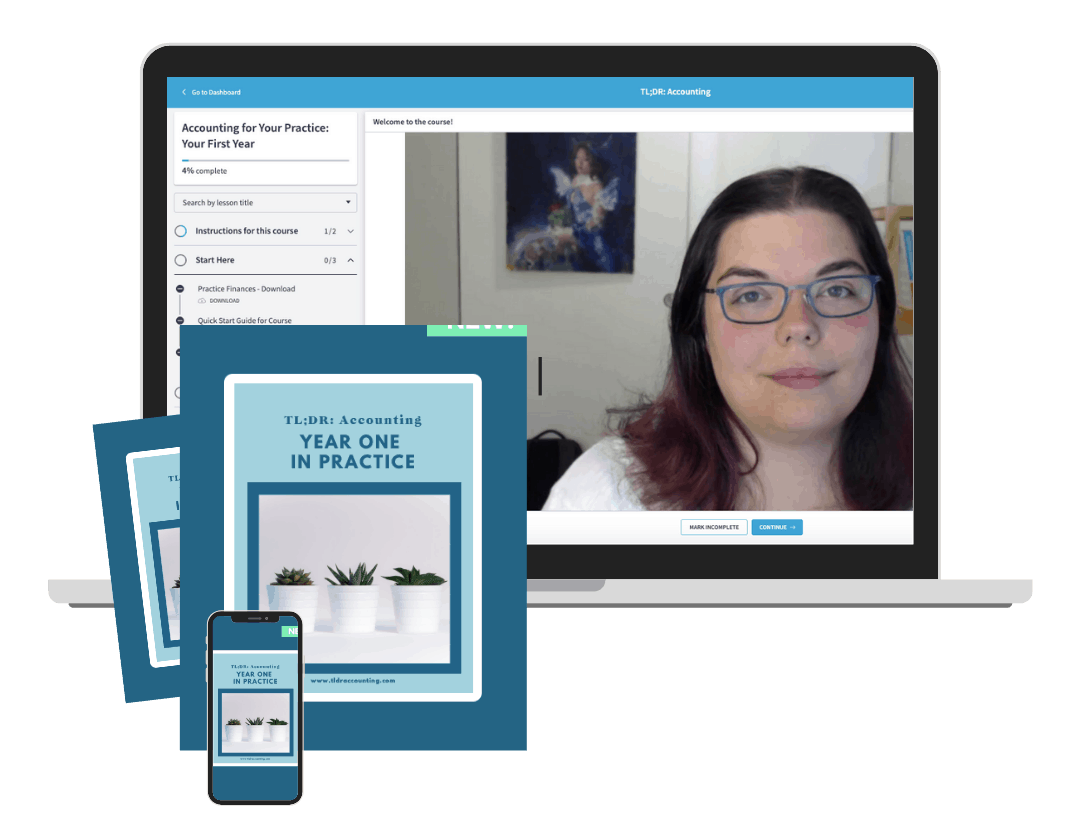

We made a course just for you!

Your First Year in Private Practice Online Course