What Retirement Accounts are Available for Small Business Owners?

Well…it depends (you knew that was coming right?).

Before giving an answer, I always ask:

- How many employees do you have?

- Are you an S-Corporation?

- How much do you want to contribute to your retirement accounts?

- Do you want as simple a solution as possible?

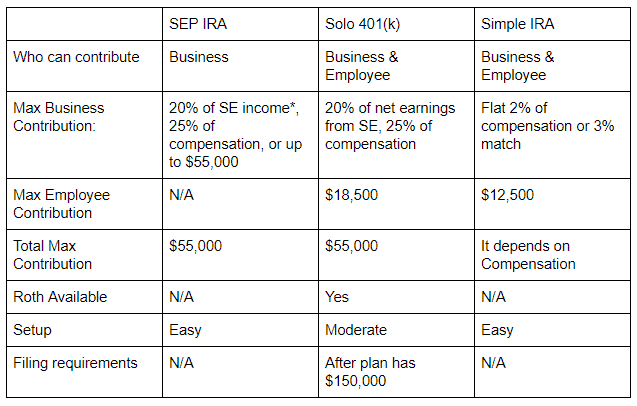

Three types of accounts work best for small business owners or freelancers:

- Simplified employee plan (SEP) IRA

- Solo 401(k)

- Simple IRA

*less half of your self-employment tax

What does this chart mean?

A SEP IRA is very similar to a regular IRA. The contributions come from the business only; there are no employee contributions. If you are self-employed, your contribution is 20% of your business net income, and if you are an S-Corporation, your contribution is 25% of your compensation. A SEP IRA tends to be a great plan for a small business owner with no employees.

A Solo 401(k) is similar to a 401(k) offered from an employer. You can make contributions from your paycheck and the business can make contributions as well. A Solo 401(k) does have filing requirements once the plan gets big enough. The “solo” part of a Solo 401(k) is because the plan only works if you don’t have employees.

If you do have employees, a Simple IRA is a very straightforward plan that offers two options: a flat 2% of compensation or a 3% match of compensation.

So, what retirement account is right for me?

Most of our small business clients who have no employees tend to use SEP IRAs. Our small business owner clients who do have employees usually use Simple IRAs.

We always recommend you talk to an advisor to determine which option is best for you and your circumstances.

TL;DR: Retirement planning might be a pain, but you should still be saving for it.