“Business or pleasure?”

You’ve probably heard this phrase before in reference to travel. Today we’re going to examine the same idea with respect to expenses. The distinction between personal and business expenses is super important because it has everything to do with whether you can deduct the expense on your taxes.

Let’s break it down: for an expense to qualify as a business expense, it must be all of these:

- Reasonable,

- Ordinary, and

- Necessary

…for the running of your business.

What is a Reasonable Expense?

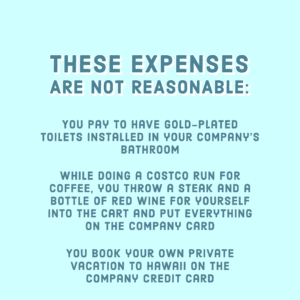

What is a reasonable expense? It is hard, if not impossible, to come up with a black-and-white test for whether an expense is reasonable. However, it is easy to come up with examples of unreasonable expenses:

- You pay to have gold-plated toilets installed in your company’s bathroom

- While doing a Costco run for coffee, you throw a steak and a bottle of red wine for yourself into the cart and put everything on the company card

- You book your own private vacation to Hawaii on the company credit card

Note that these items all relate to things you buy for the company or for yourself with company money. If you buy steak to share with your employees at the company potluck, it can qualify as deductible meals expense. If you reward your top salesperson with a vacation to Hawaii, this can ultimately count as deductible compensation (just note that your employee will be subject to paying payroll and income tax on the value of their vacation).

What is an Ordinary Expense?

Whether an expense is ordinary depends on the nature of your business. Let’s say you spend $1,000 on pet food every month for an exotic menagerie of tropical birds. If you run a zoo, great! If, on the other hand, you’re a paperclip manufacturer, then look around you. Are other paperclip manufacturers keeping hordes of exotic pets? Probably not, which means that it’s not an “ordinary” expense.

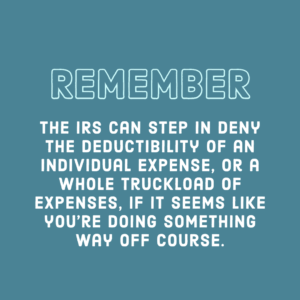

The IRS does not expect you to robotically conform with your competitors. But, the IRS can step in deny the deductibility of an individual expense, or a whole truckload of expenses, if it seems like you’re doing something way off course. Your business may be extraordinary, but make sure that your expenses are ordinary. That is to say, make sure they’re common and accepted within your industry—expenses that would be expected in whatever situation your company finds itself in.

Note that usual is not a requirement. Maybe this is an expense that you will only pay once during the entire run of your business. In that case it can still be deductible if it passes all the other criteria. A good example of this might be paying someone to clear all the bats from your workplace’s attic: this is unusual, but it’s good for employee morale to not have to worry about random bat attacks.

What is a Necessary Expense?

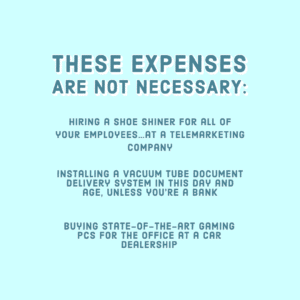

Maybe you’ve had the kind of meeting where your accountant asks, “Is this truly necessary?” Much like our other requirements for business expense, there is no fine line to determine if an expense is necessary. But we can look at some examples of unnecessary expenses:

- Hiring a shoe shiner for all of your employees…at a telemarketing company

- Installing a vacuum tube document delivery system in this day and age, unless you’re a bank

- Buying state-of-the-art gaming PCs for the office at a car dealership

If an expense could be considered “appropriate and helpful” for your business, then there’s a good chance the IRS would agree with you. An example of this might be hiring a massage therapist to set up in your break room during the busiest season of the year. Sure it might not be strictly necessary, but it certainly would be appropriate and helpful, helping to stave off burnout for your employees and perhaps boosting employee retention during a time when many might want to leave the company. Now, if you don’t have employees, it isn’t deductible unless it is a medical expense.

The Connection to Income

Perhaps a good way to determine whether an expense is business or personal, and also whether it’s reasonable, ordinary, and necessary, is asking yourself:

Does this expense help me earn income for my business, either directly or indirectly?

Of course this isn’t the end-all argument for whether an expense qualifies.

Specific IRS Rules About Business Expenses

As you saw above, the standards of reasonable, ordinary, and necessary are not crystal clear. However, there are some very specific expenses that the IRS has said are not deductible as business expenses:

- Commuting expenses: Unfortunately, you are simply not allowed to deduct the gas, depreciation, and parking expenses involved with commuting to and from work.

- Many people get excited about the idea of deducting the cost of work uniforms. The regulations on this are very strict. To perhaps oversimplify, the only clothing you can deduct is clothing that would make you look like a dork if you wore it to a social event (think of a gas station employee uniform with your name on your chest within a white oval).

- Gifts to customers are only deductible up to $25 per customer per year. Exception: Branded items like sunglasses, tote bags, or pens are fine to give away with impunity. Gifts to employees are fine, just know that they may need to be considered as compensation—check with your accountant (or us!) about that.

- The home office deduction is a topic by itself!

- It may be no surprise to you that bribes are not tax deductible, even if an argument can be made that they are reasonable, ordinary, and necessary.

Don’t Mix Business and Personal Expenses!

Mixing business and personal expenses can land you in hot water.

Do you own a corporation or other entity that enjoys limited liability? If so, then you can lose the liability limitations of your business if you intermingle business and personal expenses. This is called piercing the corporate veil and it is very, very bad. One of the biggest reasons you set up a company, limited liability status, can be ruled out by courts if you disrespect the separation between you and your business.

In other words: If you lose your limited liability protection, then people who sue your company can come after YOUR personal savings and property!

Even if you don’t own a corporation and you do business in your own name or as part of a partnership, it is always bad form to mix business and personal expenses. If you forget to separate your personal expenses before tax time, then you may end up filing your taxes incorrectly which can lead to penalties and interest charges from the IRS.

TL;DR: If an expense is reasonable, ordinary, and necessary, and it directly or indirectly helps you earn income for your business, then it’s probably deductible as a business expense. Make sure to separate your business and personal expenses by using different bank accounts and different credit cards. Need more help? Schedule a session with one of our expert accountants! We’re more than happy to help.