Wedding bells are ringing! If you have or are about to marry the love of your life, life probably feels just perfect right now, and we here at TL;DR wish you a long and happy marriage.

But how does marriage impact your taxes? Tying the knot causes some changes in how you file your taxes.

Changes in Filing Status After Getting Married

After you get married, should you choose to file your taxes as married filing jointly or married filing separately?

Married Filing Jointly

Married filing jointly is usually the biggest (tax) change that occurs after getting married. Married filing jointly means you and your partner file your taxes together. You both report the combined total of all of your income and deductions. This is the simplest way to file your taxes when you are married — especially if you live within Washington State.

Married Filing Separately

Washington State is a community property state. This means that once you are married, you and your spouse own an equal share (50/50) of any money you bring into the marriage and any debts incurred during the marriage.

So what does this mean for your tax return?

It means that if you file married filing separately, you need to split any community property 50/50 on your return. It means partner A’s wages of $50,000, and partners B’s wages of $100,000 would need to be split on each of your returns. In this example, you each would report $75,000 income on your separate returns.

You also lose the following deductions:

- The child and dependent care tax credit

- The adoption credit

- The Earned Income Credit

- Tax-free exclusion of U.S. bond interest

- Tax-free exclusion of Social Security benefits

- The credit for the elderly and disabled

- The deduction for college tuition expenses

- The student loan interest deduction

- The American Opportunity Credit and Lifetime Learning Credit for higher education expenses

- The deduction of net capital losses

- Traditional IRA deductions

- Roth IRA contributions

Unless you are on an income-based repayment plan for your student loans, we normally do not recommend married filing separately.

Can I just file as single?

No – the IRS frowns on this. Because you are married, some things have changed in regards to filing your taxes.

Doubling of the standard deduction

With the current tax law the standard deduction is $12,200 for single. The standard deduction for married taxpayers is $24,400.

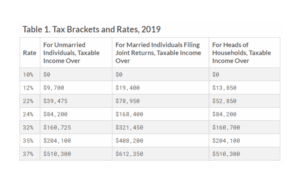

Tax Rates

TL;DR: Congrats on getting married. If you are worried about how marriage will affect your taxes, schedule a tax projection for engaged couples to see what your future return will look like.